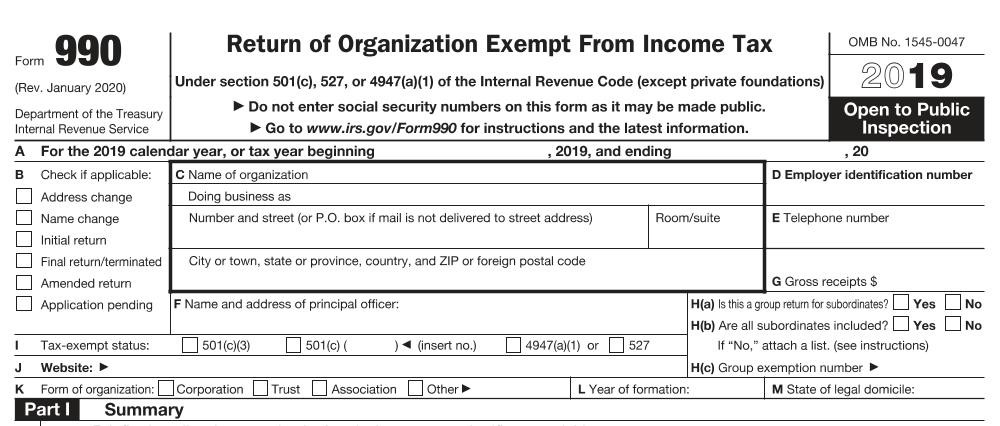

Understanding the 501(c)(3) Public Support Test

Over the course of our many years in business, we have found the public support test to be among the least understood topics by nonprofits, especially smaller organizations. But, it is absolutely critical to understand how it works, lest your nonprofit…