How to File a Form 990: Best Practices for Easy Preparation

IRS Form 990 is the most critical annual compliance filing for nonprofits. It’s like a window into your nonprofit, which makes it a challenging tax (information) return to complete. That’s where this guide comes in.

We’ll answer all the questions you may have about how to file a Form 990, including its essential components and the key steps to take for easy preparation in the following sections:

There are ways to prepare in advance to make sure that the actual task of completing and filing Form 990 is less stressful. The best method of all is to trust a professional bookkeeping and compliance expert to get your organization ready to file. Keep that option in mind as you explore more information about this essential form.

What is Form 990?

Form 990 is the tax return form that tax-exempt organizations must submit annually to the IRS. This document serves as a system for checking the legitimacy of your nonprofit’s financial activity so you can maintain your tax-exempt status.

What Are The Different Types of Form 990?

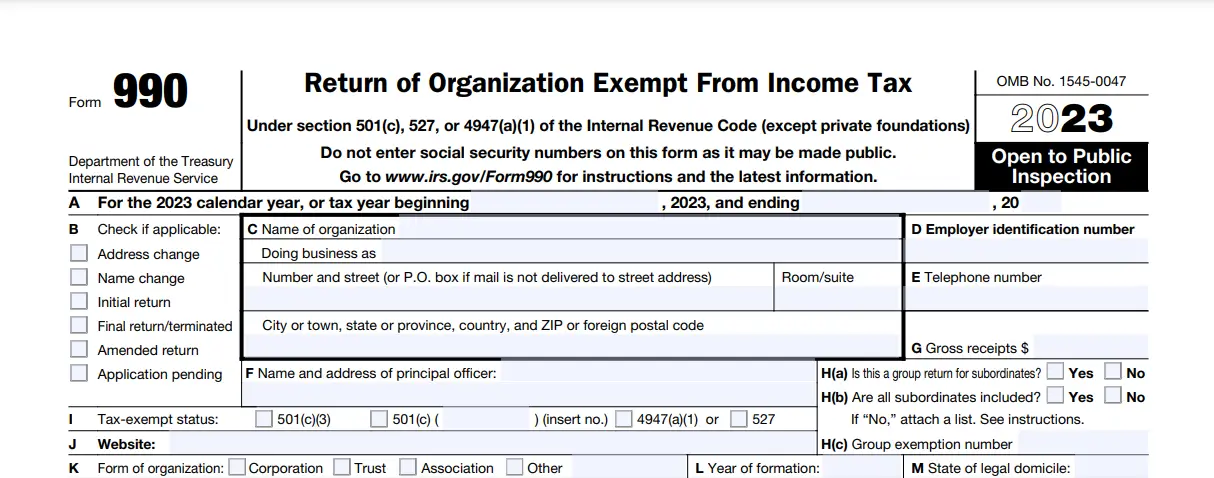

There are four versions of Form 990, which correspond to the filing organization’s annual gross receipts and total assets. The full form must be filed by organizations with gross receipts of $200,000+ or total assets of $500,000+. This version of the form generally looks something like this:

The three other versions include:

- Form 990-EZ: This form is for nonprofits with gross receipts totaling between $50,000 and $200,000 and total assets equaling less than $500,000.

- Form 990-N (e-postcard): This form is for nonprofits with gross receipts totaling under $50,000 or less.

- Form 990-PF: This form is for private foundations, regardless of their gross receipts or total assets.

Once you’ve determined which version you must file, you must be prepared to file on time, as the IRS enforces a strict deadline. Form 990 is due on the 15th day of the fifth month after the end of the fiscal year unless the IRS approves an extension.

So, for example, if your nonprofit’s fiscal year follows the calendar year, then your tax forms would be due on May 15. If your nonprofit can’t meet this deadline, you can apply for an extension by filing Form 8868, which (if approved) pushes the deadline to November 15.

What’s Included In The Full Version of Form 990?

The full version of Form 990 is broken down into multiple schedules. Here are a few of the schedules you may be required to complete:

- Schedule A: This section is where you’ll provide the public charity status of your organization and information about public support.

- Schedule B: This section is also called the Schedule of Contributors, and it’s where you’ll report information about the contributions you report.

- Schedule C: This section is used to provide any information about political campaign activities or lobbying activities.

- Schedule D: In this section, your nonprofit must report donor-advised funds (DAFs), conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

- Schedule F: Here, you’ll provide information on any activities conducted outside of the United States.

- Schedule G: This is where your nonprofit will report any professional fundraising services used.

- Schedule J: This section is where your nonprofit will report compensation information for certain executives, such as officers, directors, and key employees. You’ll also need to provide information on certain compensation practices.

- Schedule M: This schedule collects information about any noncash contributions your nonprofit received throughout the fiscal year.

The information your nonprofit is required to report depends on your unique financial situation, including the types of donations you receive and the activities you conduct. Depending on which schedules you need to complete, the return may end up being 20 pages or more.

Given the complexity of the form and the massive amount of information you’ll need to complete it, the best way your nonprofit can file a Form 990 is with the help of an expert.

Why Do Nonprofits Need to File a Form 990?

Your nonprofit’s tax-exempt status hinges on its ability to raise donor support and/or program revenue and to use those funds to drive your mission forward. Form 990 is the primary way the IRS keeps tabs on that.

With detailed information about your organization’s financial activity, the IRS can ensure that no organization exploits its tax-exempt status and that 501(c)(3) organizations truly work to fulfill their charitable purposes.

Additionally, Form 990 is an excellent way to demonstrate your nonprofit’s transparency and financial responsibility to potential supporters. The general public may look at your organization’s form to observe:

- How much is raised in donations

- Compensation for executives

- Amount spent on programs

- Fundraising costs

- Details on program accomplishments during the year

The most important reason nonprofits must learn how to file a Form 990 correctly and remember to complete it before the deadline is simply because it’s a requirement. Failure to file a Form 990 for three consecutive years will result in the revocation of your organization’s 501(c)(3) status.

How to File a Form 990 in 5 Steps

1. Keep Track of Your Finances for Form 990

Form 990 is an examination of your income, expenses, and activities. So it only makes sense that the best way to prepare for the form is by keeping track of your nonprofit’s financial records.

So how exactly can you keep track? There are several ways:

- Use a real bookkeeping or accounting app. Don’t rely solely on written records to track financial activity. There are a number of affordable and accurate web-based accounting apps that can help you create periodic financial reports. Plus, online apps like these allow you to log on from anywhere with an internet connection. Mobile accounting also makes it much easier to provide your bookkeeper, accountant, or tax preparer access.

- Keep your records current. For these tools to make a difference, you actually have to use them properly and regularly. Stay on top of your records to avoid having to reconcile your books before starting your Form 990. That way, you can focus solely on the form instead of worrying about your records, too.

- Make sure your books reflect accounting standards for nonprofits. This is a tough one, particularly for those keeping their own books. You’ll need to properly account for circumstantial situations, such as restricted gifts, and you could risk messing something up if you don’t know what you’re doing. Hire a professional bookkeeper who knows how to do it right.

Failing to track your finances is not only irresponsible, but it’s also a violation of state and federal regulations that require tax-exempt organizations to maintain accurate books. Start keeping records now to maintain compliance and avoid financial issues down the line.

2. Record Donor Information to Include in Your Form 990

It’s important to track information about your donors and their donations and keep this data indefinitely. Donor data tracking is just as important to your Form 990 as orderly financial records for two reasons:

- They’re related. Your donors’ contributions likely make up your organization’s income.

- The IRS requires donor data. You’ll need this information readily available to provide a list of your biggest contributors to the IRS. Plus, this data is necessary to calculate your annual public support percentage.

Track donations in an online app designed for nonprofits with your organization’s structure and needs. Smaller organizations with fewer donors might be able to record donations in an Excel spreadsheet, or something similar. However, there are a variety of software platforms for any organization size to help you organize this information.

3. Track Your Activities and Accomplishments

As you prepare to file, you might understand the basics of Form 990 to include financial records and donor history. But relatively few organizations think to record activities and accomplishments as the year rolls along.

Form 990 requires filers to list their individual charitable programs by name or purpose, then describe in detail what was accomplished during the year. For example, you may need to include things like:

- A description of the program

- The number of people served

- Income and expenses allocated to the activity

- Whether it was a new program or the continuation of an existing one

Instead of scrambling to put this information together when it’s time to file your Form 990, keep track of it as it happens. This makes filing easier for your nonprofit and ensures you report detailed and accurate information.

4. Get a Head Start on Form 990 Preparation!

There’s a reason our Compliance Team works 16-hour days during select weeks in May and November. Clients sometimes underestimate what’s required in their Form 990, forcing them to scramble at the last minute to submit their information. Every tax firm deals with this reality.

Filing a late Form 990 subjects your nonprofit to a penalty of $20 per day, plus compounded interest for every day that your return is late. Left unchecked, these penalty assessments commonly reach thousands of dollars worth of fines. And, if your nonprofit brings in over $1 million per year, the penalty is $100 per day!

Starting your Form 990 preparation early will benefit your nonprofit in the long run, not only by avoiding late fees but also by staying on top of compliance requirements.

5. Hire a Nonprofit Tax Professional to File Form 990 For You

As the old saying goes, “You don’t know what you don’t know.” This is especially true when it comes to Form 990 preparation.

Form 990 is a complex tax return, requiring in-depth knowledge of nonprofit tax law and compliance, plus accounting standards for nonprofits. Very few charitable organizations have someone on the inside with the requisite experience necessary to prepare an accurate return.

Chances are, you wouldn’t attempt to work on your modern, computer-controlled car if you’re not a certified mechanic. The same logic applies here. Trust a professional to prepare Form 990 for your nonprofit.

Final Thoughts on Filing a Form 990

Among the numerous requirements of nonprofit compliance, Form 990 is a crucial and complex filing. Making a comprehensive list of all the information you’ll need to file and organizing this data throughout the year is a necessity.

However, if you would rather focus your resources on fundraising, marketing, and furthering your nonprofit’s mission, do that! Nonprofit tax professionals exist to take care of your organization’s tax filings and compliance requirements. No matter how you approach Form 990, make sure you have a structured plan and well-kept data to file it efficiently.

For more information about filing a Form 990, check out the following video:

Comments (1)

Comments are closed.

Thanks