What is IRS Form 990?

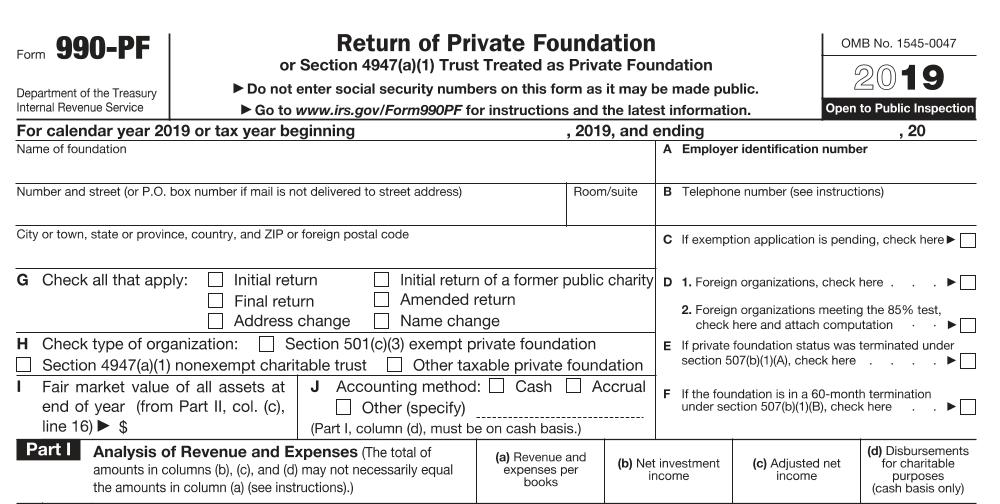

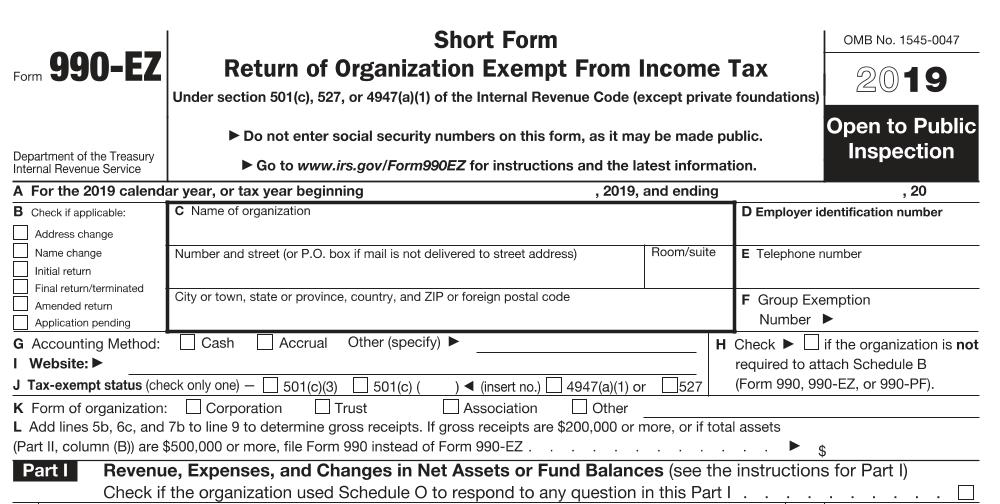

The instructions for IRS Form 990, the long form, are 103 pages long. IRS Form 990-EZ, its mid-range form, instructions are 48 pages long. IRS Form 990-PF, only for private foundations – but required of all private foundations regardless of…