If you’re wondering how to start a 501(c)(3), know that legal, accounting, and technical hurdles must be cleared along the way. Since Foundation Group’s inception in 1995, we’ve assisted over 25,000 organizations and maintained a 100% IRS approval rate.

We know the ins and outs of starting a 501(c)(3), including:

If you want to learn more, or even let the experts help you do it, you’ve come to the right place.

Watch Our Founder & CEO Explain the Steps for Obtaining 501(c)(3) Status

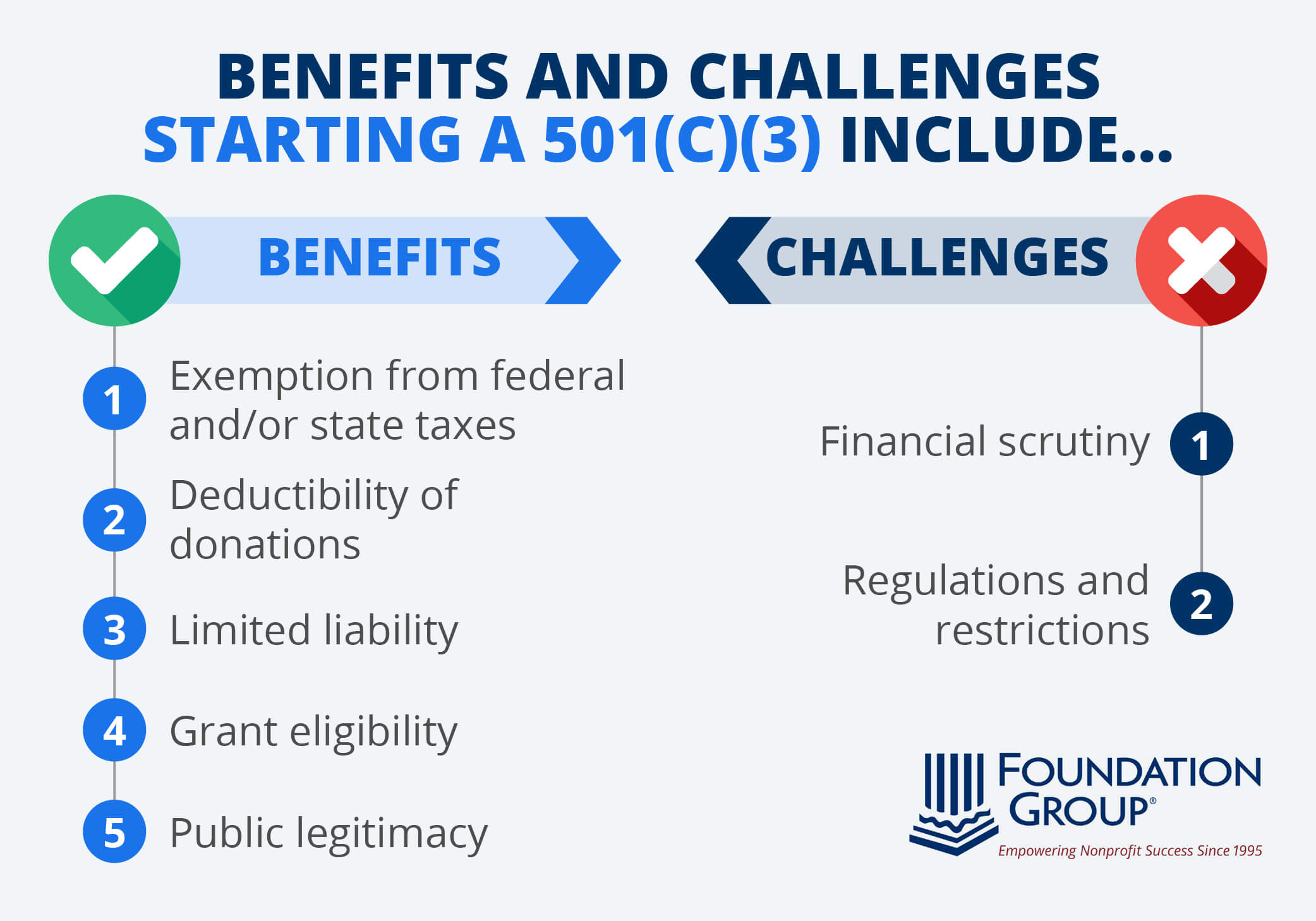

Should I Apply for a 501(c)(3)? Benefits and Challenges

Benefits:

- Exemption from federal and state taxes: 501(c)(3) organizations are exempt from federal and state taxes.

- Deductibility of donations: Donors may be able to claim tax deductions on their tax returns for funds donated to your nonprofit.

- Limited liability: Forming a corporation establishes the organization as a separate entity from its founders. This legally protects officers, directors, and other key individuals from liability. It even protects your supporters, like volunteers, in case of an accident while helping out your organization.

- Grant eligibility: 501(c)(3) organizations can apply for government and private grants, offering more funding opportunities and flexibility to fulfill your mission.

- Public legitimacy: With 501(c)(3) designation, your organization will bolster its reputation as credible and trustworthy because of the scrutiny it undergoes from the IRS.

Challenges:

- Financial scrutiny: To obtain and maintain 501(c)(3) status, your organization must prove it will use donations to fulfill its charitable purpose. This means you’re required to submit annual financial statements and undergo financial scrutiny from the IRS.

- Regulations and restrictions: Your organization must comply with specific regulations regarding its use of donations to maintain 501(c)(3) status. For example, your ability to participate in political activity will be more limited than a non-exempt organization.

The good news is that these challenges are manageable with the help of a nonprofit compliance expert. At Foundation Group, we help 501(c)(3) organizations hold up to financial scrutiny through reliable bookkeeping services and Form 990 filing support. Additionally, our team knows the ins and outs of nonprofit compliance, ensuring organizations like yours reduce risk and advance their missions.

5 Steps to Start a 501(c)(3)

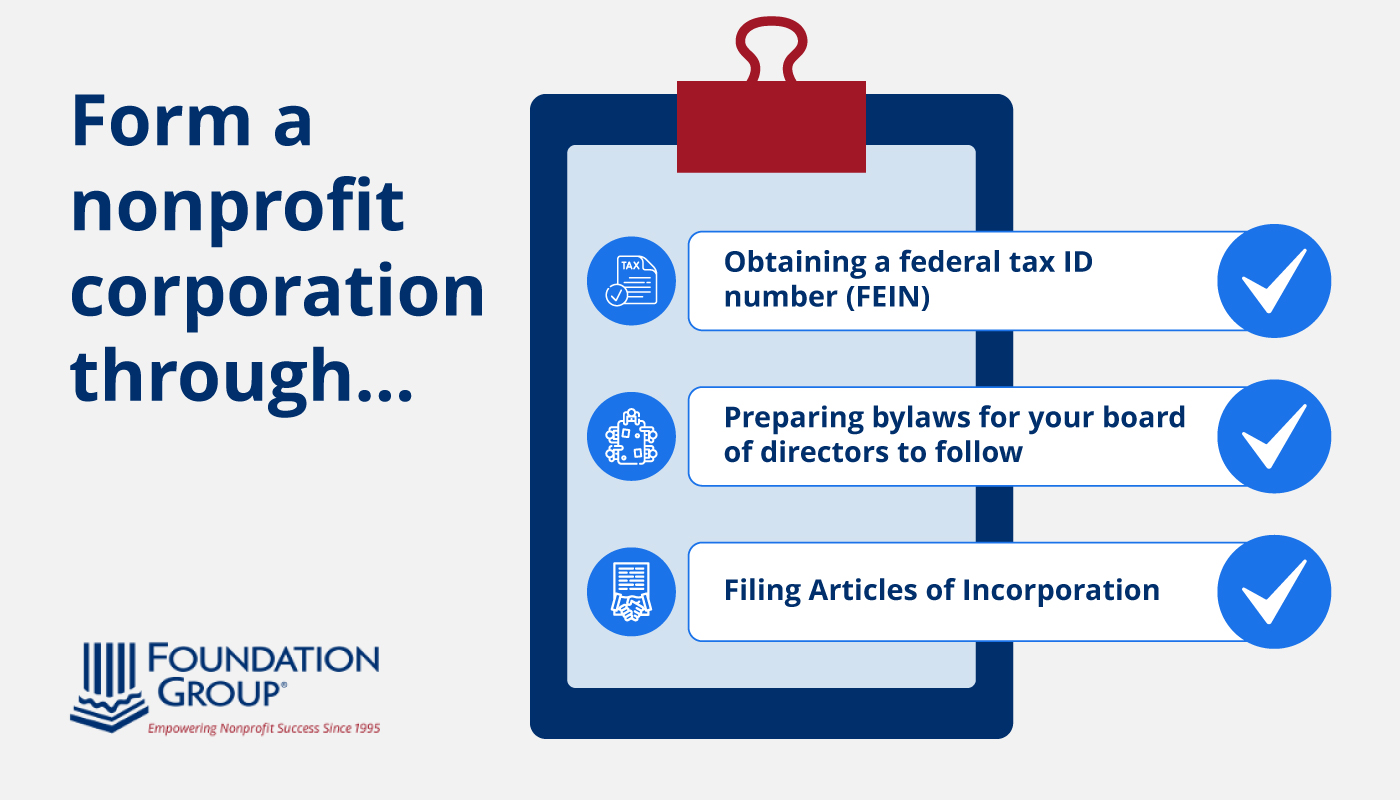

1. Establish a Nonprofit Corporation

The majority of 501(c)(3) nonprofits qualify for tax-exempt status through nonprofit incorporation. This process is exactly what it sounds like—it establishes your organization as a corporation. To do this, you’ll have to:

- Obtain a federal tax ID number (FEIN) from the IRS

- Prepare bylaws for your board of directors to follow (more on this later)

- File Articles of Incorporation at the state level

Articles of Incorporation vary slightly from state to state, so it’s important to follow your state’s instructions closely.

2. Form a Board of Directors

A nonprofit board of directors is the governing body and highest level of authority in the organization. If you’re starting a 501(c)(3), choosing dependable board members who align with your mission and values is critical to establishing strong leadership.

Identify the skills your nonprofit needs from its board members, such as experience in business, fundraising, or prior nonprofit leadership. Then, consider people in your network who might be interested in and passionate about your mission.

Some states require applicants to list the names of board members during the incorporation process. In this case, you may need to swap steps #1 and #2.

3. Write Your Bylaws

Bylaws are a legal document dictating how your board of directors will govern the nonprofit. Most bylaws include standard provisions, such as:

- The nonprofit’s name

- Purpose statement

- Governing structure

- Types and frequencies of required meetings

- Bylaw amendment rules

Other bylaw inclusions may be required by your nonprofit’s state. These bylaws will be submitted to the IRS when you apply for a 501(c)(3), so it’s important to ensure they contain all the necessary provisions.

4. Apply for 501(c)(3) Status

A nonprofit corporation can apply for recognition of 501(c)(3) tax-exempt status by filing IRS Form 1023. This process is much more complex than filing for incorporation because:

- The form itself is up to 28 pages long. After including the required attachments, schedules, and other necessary materials, it is not uncommon for these submissions to the IRS to be up to 100 pages.

- The IRS uses it to look for conflicts of interest and potential benefits to insiders. Both of these are possible grounds for denial.

Think of Form 1023 as an IRS examination. The 501(c)(3) application process is like an audit of proposed (and/or previous) activity. It examines the organization’s governing structure, purpose, and planned programs to ensure the organization is formed exclusively for 501(c)(3) purposes.

If your plan meets all the qualifications, you’ll receive a letter of determination. This is your official confirmation of 501(c)(3) status.

5. Complete State Filings

![Foundation-Group_How-to-Start-a-501c3_Map [Compressed] A map showing the states that require and don’t require charitable solicitations registration.](https://www.501c3.org/wp-content/uploads/2024/10/Foundation-Group_How-to-Start-a-501c3_Map-Compressed-1024x566.jpg)

While obtaining 501(c)(3) status grants your new nonprofit federal tax exemption, there are two other critical state issues that must be addressed:

- Charitable Solicitations Registration. This is a required registration in 40 states and is usually administered through the Attorney General’s office, though not always. Most states require registration prior to soliciting donations.

- State Corporate Tax Exemption. Most states recognize the federal 501(c)(3) status as valid for state corporate tax exemption. California and Texas are big exceptions, requiring their own application process for charity status in their state. Several other states require a separate application, but those are typically simpler registrations.

FAQs

How much does it cost to start a 501(c)(3)?

Both your state and the IRS charge filing fees for the documents that must be submitted for incorporation and 501(c)(3) status. These fees will usually range between $500-$1,000 in total. There are additional fees associated with hiring a professional service provider like Foundation Group, but those fees are typically far below the cost of hiring a non-specialist attorney.

How long does it take to apply for a 501(c)(3)?

As mentioned earlier, Form 1023 can be up to 100 pages long after including the required attachments, schedules, and other necessary materials. The IRS estimates that preparing this form could take a novice well over 100 hours. Processing times vary greatly, but it typically takes the IRS between 3-9 months to review your submission and issue a determination letter.

Can you be a nonprofit without 501(c)(3)?

Nonprofits exist without 501(c)(3) determination, but they aren’t tax-exempt and don’t reap the benefits of having 501(c)(3) status. There are few, if any, use cases for forming a nonprofit that doesn’t seek and obtain tax-exempt status.

Do you have to be a 501(c)(3) to get grants?

It is legally possible to apply for grants before receiving a letter of determination, but most grantmakers disallow that. Most potential sources of funding require an approved letter of determination.

What taxes does a 501(c)(3) pay?

All 501(c)(3) organizations may be subject to taxes on “unrelated business income,” as well as federal and state payroll taxes if they have employees. Also, some states require 501(c)(3) organizations to pay sales and/or property taxes.

Nobody knows this process better than Foundation Group’s experts. Our team members are career professionals who understand exactly what is required for your organization to succeed.

Our team is managed by IRS-licensed tax professionals. We’ll work with you to properly structure your nonprofit, not only for IRS approval but also for long-term success. And once you’re approved, we provide ongoing state and federal compliance services throughout the life of your nonprofit.