Understanding the IRS Form 990

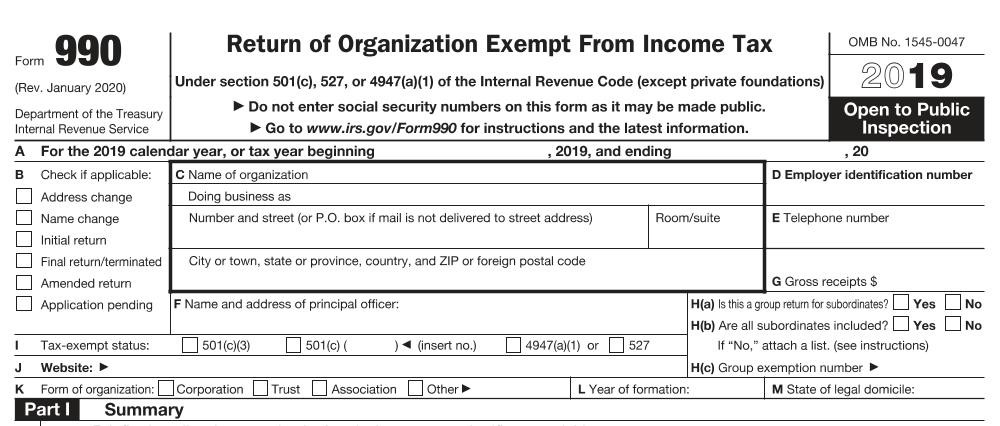

IRS Form 990, the full-length version, is arguably the most detailed tax return the average person is likely to encounter. While there are certainly IRS tax forms that are equally complex, most are used for very targeted situations, not for a standard return required to be filed by an entire class of organizations. In this post, our 4th in this series, we’re going to dig in and see what Form 990 is all about and why it is so important.

As we have worked our way up the ladder of the various versions, from the e-postcard Form 990-N, through Form 990-EZ, and now Form 990, we see that each successive version is much longer and requires more and more detailed information. This version is, by far, the most thorough one of the bunch.

Like Form 990-EZ, the long-version Form 990 requires income and expense information, board of directors disclosure, etc., only in much more detail. For example, it’s not enough to just give basic information on expenditures. Part IX of Form 990 requires those expenditures to be broken down into three classes: 1) program service expenses, 2) management and general expenses, and 3) fundraising expenses. These classes do not replace expense categories, however, but rather provides a further breakdown of the category. So, if your nonprofit has an expense category of “travel”, those travel expenses have to be further split between the three classes of expenditure. Obviously, not every expense category is going to have multiple classes, but some certainly will. This requires diligent recordkeeping throughout the year in order to be prepared.

What are some other key points regarding Form 990? The base form itself consists of 12 sections (Parts) over 12 pages…and each section is relevant to all filers. And your answers to various questions throughout the return determine which of the 16 sub-schedules (Schedules A through R) your nonprofit will have to prepare. Not every organization has to file every sub-schedule, but a few are mandatory. Let’s look at the list:

- Schedule A – Public Charity Status and Public Support: Schedule A is required of all filers and is used primarily to determine if a public charity has a sufficiently broad level of donor support (the Public Support Test). 501(c)(3) public charities that do not maintain a 5-year average of at least ⅓ of their revenue coming from a relatively broad base (small donors, government grants, etc.) may have their status downgraded to private foundation.

- Schedule B – Schedule of Contributors: Schedule B, also required of all filers, generally lists donors who gave more than $5,000 during the reporting year. Even if your nonprofit had none, this sub-schedule is required.

- Schedule C – Political Campaign and Lobbying Activity: As the name suggests, only those nonprofits involved in such activity would have to file this schedule.

- Schedule D – Supplemental Financial Statements: This sub-schedule provides an in-depth, topically-specific breakdown of the financial activity of donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts, endowment funds, and assets and investments. It’s the latter of the list that makes Schedule D required of many nonprofits.

- Schedule E – Schools: Schedule E is required only of schools and is used primarily to monitor for the existence of racial discrimination.

- Schedule F – Statement of Activities Outside the US: Any 501(c)(3) organization that is conducting activity of any kind outside the boundaries of the United States must complete this schedule.

- Schedule G – Supplemental Information Regarding Fundraising and Gaming Activities: While most nonprofits aren’t using gaming/gambling to raise money, most have fundraisers or other events which have a primary purpose of generating revenue for the organization. As such, most filers will be required to complete Schedule G.

- Schedule H – Hospitals: This sub-schedule is required of not just hospitals, but any nonprofit with significant activity involving the providing of healthcare services.

- Schedule I – Grants and Other Assistance to Organizations, Governments, or Individuals: Any nonprofit that is giving or granting funds to other nonprofits, government entities, or people, even charitable benevolence, must complete Schedule I.

- Schedule J – Compensation Information: Is your nonprofit paying staff, board members, or others performing services? If so, Schedule J will need to be a part of your return.

- Schedule K – Supplemental Information on Tax-Exempt Bonds: This is one of the more narrow sub-schedules, only to be prepared by those organizations raising money by issuing bonds.

- Schedule L – Transactions With Interested Persons: Nonprofits that have business or other dealings with what the IRS calls disqualified persons, such as board members, officers, key employees, and significant donors (or people related to them), must disclose and detail these transactions on Schedule L. This is an area of high-level scrutiny, where the IRS is looking for evidence of improper self-dealing. Adopting a comprehensive conflict-of-interest policy, and following it, goes a long way to preventing problems here.

- Schedule M – Noncash Contributions: Does your nonprofit have donors who give in-kind, tangible gifts? If so, Schedule M is where you provide the details.

- Schedule N – Liquidation, Termination, Dissolution, or Significant Disposition of Assets: This sub-schedule is used to detail to the IRS the distribution of assets required when a 501(c)(3) organization winds down and ceases operation. As such, it is typically only filed once, along with a nonprofit’s final Form 990.

- Schedule O – Supplemental Information to Form 990: This is the catch-all sub-schedule of Form 990. Schedule O is used as a breakout section to provide details on a variety of affirmative questions from the main return. Most organizations filing Form 990 will have something to disclose on Schedule O.

- Schedule R – Related Organizations and Unrelated Partnerships: Rounding out our list is a sub-schedule that is filed only by those nonprofits who are conducting significant activities along with other, related nonprofits or partnerships with unrelated entities.

As you can see, it is an exhaustive amount of information. It is not uncommon for Foundation Group’s Compliance Team to prepare Form 990 returns for clients that exceed 50 total pages!

Like all versions, the long-version of Form 990 is due on the 15th of the 5th month, following the end of the fiscal year. There is a paper version of the form which may be filed by mail, as well as the ability to file electronically with the IRS (which they prefer). A six-month extension is available by filing IRS Form 8868 by the original due date of the return. Significant penalties are assessed for late filing.

Another stipulation, and the most important one, is the associated revenue and asset-valuation thresholds. To be required to file Form 990, a nonprofit should have a gross income of more than $200,000 during the past fiscal year. Also, nonprofits with assets collectively valued greater than $500,000 must file Form 990, even if their revenue is less than $200,000.

Form 990 is a beast of an information return. Unless your nonprofit has someone on the inside with specialized training in preparing such a return, we highly encourage you to seek competent assistance. Foundation Group prepares hundreds of these returns for clients each year. If your organization needs help, don’t go it alone. Reach out to us. We’re here for you!

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (3)

Comments are closed.

Hi Greg,

I just wanted to commend you on this breakdown. It is plainly written and exceedingly accessible. Thank you for taking the time to write this.

I dearly need help in filling these forms

Give us a call, Denis. Our firm can help.