How to Handle a Revoked 501(c)(3) Status in 5 Steps

Some days, there are pieces of mail you really wish you didn’t receive. Bills, late notices, warranty expirations, or recalls on your car are all examples of items we’d rather not get. But one piece of mail you really don’t want to see in your mailbox is IRS Notice CP120A—Notice of Revocation of Tax-Exempt Status.

Thankfully, nonprofits can regain their 501(c)(3) status even if they receive this unfortunate letter. In this guide, we’ll lay out everything you need to know in case this happens:

- What Does It Mean to Have Your 501(c)(3) Status Revoked?

- 5 Critical Steps To Take After 501(c)(3) Revocation

The IRS updates its list of automatic revocations each month, and your nonprofit needs to be prepared in case it finds itself on that list.

What Does It Mean to Have Your 501(c)(3) Status Revoked?

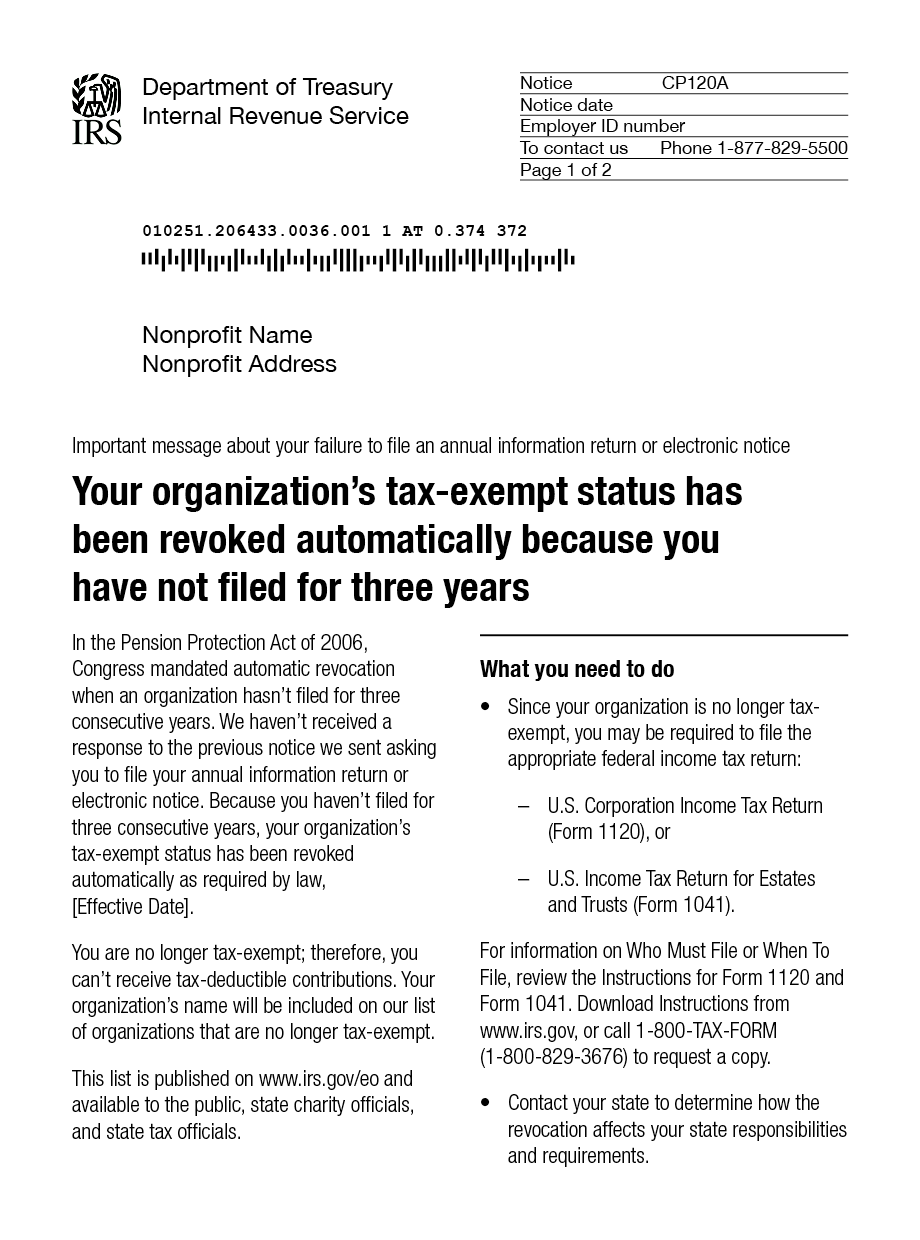

As a result of the 2006 Pension Protection Act, the IRS automatically revokes the 501(c)(3) tax-exempt status of any nonprofit that fails to file Form 990 for three consecutive years. If your status is revoked, it means your organization can no longer collect tax-deductible donations and may be required to file federal income tax returns and pay applicable income taxes.

Notice CP120A is the letter the nonprofit receives if this happens. It may look something like this:

This auto-revocation of 501(c)(3) status will usually happen without warning and is not appealable.

5 Critical Steps To Take After 501(c)(3) Revocation

The good news is that it is possible to get your 501(c)(3) status restored. But you must understand and follow the correct process in order to get back what you lost.

Check out the video below for a quick overview of the steps you’ll need to follow:

Let’s review these steps in more detail.

1. Stop Soliciting Donations

Effective as of the revocation date on your CP120A notice, your nonprofit is no longer a tax-exempt charity. This means you no longer have 501(c)(3) status, and donations to your organization are not tax-deductible to the donor.

Continuing to solicit donations either explicitly or implicitly communicates that your organization is still a 501(c)(3)—which is false information. Even if you’re taking steps to regain 501(c)(3) status, remove “tax-deductible” language from any messages that ask supporters to donate until you successfully get it back.

2. Publicly Address Your 501(c)(3) Status Revocation

In addition to ceasing all donation solicitation, it’s critical to straightforwardly reflect your change in status, particularly to frequent or regular donors.

Transparency about your status revocation is important for two reasons. First, allowing your donors to believe your nonprofit still has tax exemption could violate state and federal statutes, leaving your nonprofit leaders guilty of fraud. Failure to inform them of your status revocation is a form of fraudulent representation.

Second, clarity about your nonprofit’s status can build trust among supporters. Gaining public support is important to the success of your nonprofit for many reasons, and admitting your organization’s slip-up is a good way to start. Donors will appreciate that your nonprofit is looking out for their best interests and know that they can trust you to keep them in the loop.

This might include making updates to your:

- Website. Revise any descriptions of your nonprofit as a “tax-exempt organization.” You might also add a notice to your website, briefly stating what happened and what your next steps are for clarity and transparency.

- Communication channels. Check your email templates, social media channels, and newsletters for mentions of your 501(c)(3) status and remove them. Consider sharing the notice about your status revocation and planned next steps via email and social media.

Your donors might still be allowed to claim their donation if they can prove they believed it was tax-deductible, but your nonprofit will face penalties and injunctions.

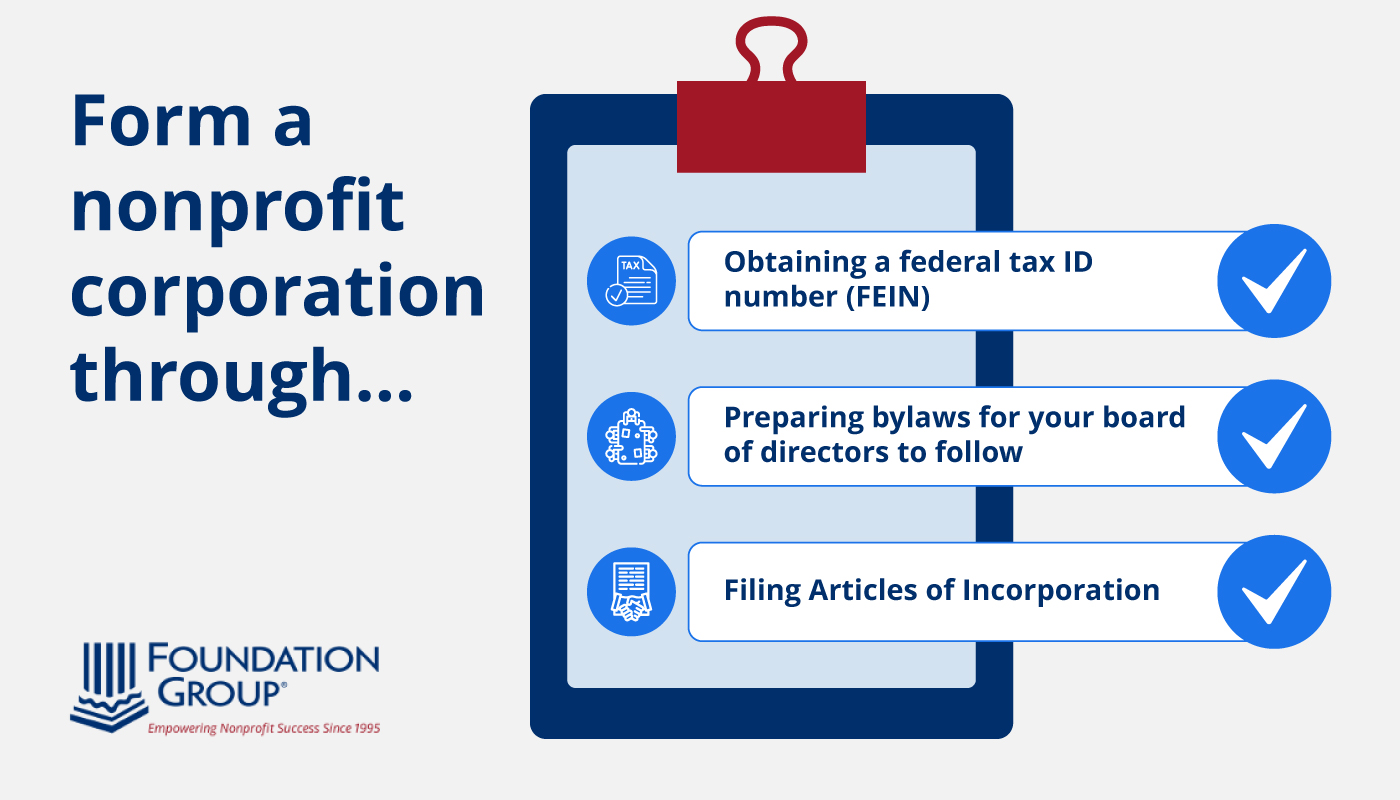

3. Do Not File New Articles of Incorporation

It’s tempting to think that 501(c)(3) status revocation will send your nonprofit right back to square one. But losing your 501(c)(3) status doesn’t mean all of this hard work is lost. State incorporation is what makes your nonprofit a real entity. Remember the lengthy steps this process involves:

- Obtaining a Federal Identification Number (FEIN)

- Preparing bylaws for your board of directors to follow

- Filing Articles of Incorporation

501(c)(3) status, on the other hand, is just how the IRS categorizes your organization for tax purposes.

Assuming you’ve been following your state’s requirements, like filing a corporate annual report each year, your nonprofit still legally exists as a nonprofit corporation. There is no need to file new Articles of Incorporation—just verify that your corporate status is still active at the state level. Then, you can apply for 501(c)(3) status reinstatement.

4. Apply for 501(c)(3) Status Reinstatement

Once your status has been revoked, you have to apply to the IRS to get it back. You will use Form 1023 just like you did the first time, except you will need to indicate that it is an application for reinstatement, not a first-time filing. Be prepared to provide the same level of detail as before, except you will be mostly reporting prior-year activities rather than a forward-looking projection.

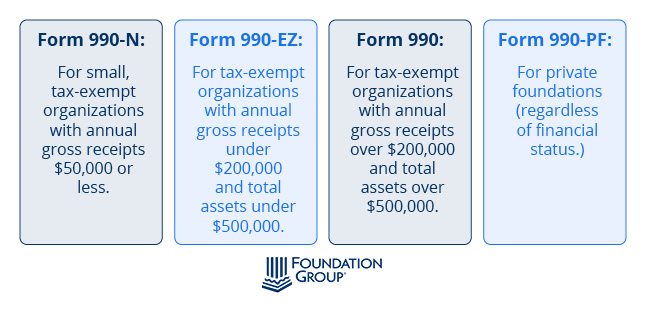

Since you missed three years of Form 990 filing, you may have to make up for lost time by preparing the forms that were supposed to be filed. The correct form and next steps depend on your nonprofit’s gross receipts and total assets for those respective years:

- Form 990-N: For small, tax-exempt organizations with annual gross receipts of $50,000 or less. If your nonprofit missed three years of filing Form 990-N, you will not need to prepare and file for the missed years with your new Form 1023 application.

- Form 990-EZ: For tax-exempt organizations with annual gross receipts under $200,000 and total assets under $500,000. If your nonprofit was supposed to file this form for even one of the three missed years, you will have to prepare and file it with your new Form 1023 application.

- Form 990 (standard form): For tax-exempt organizations with annual gross receipts over $200,000 and total assets over $500,000. You will have to prepare and file this form for all three years if you were supposed to file it for even one of them.

- Form 990-PF: For private foundations (regardless of financial status).

For example, let’s say your nonprofit needed to file Form 990-N in 2022 and 2023. Then, in 2024, your fundraising success skyrockets! Your annual gross receipts exceed $200,000 and you need to file Form 990 (the standard form). If you missed all three of these filings, you’ll need to prepare and file the higher level of Form 990 for all three years with your new Form 1023 application. That means you’d prepare Form 990 (the standard form), for 2022, 2023, and 2024.

The IRS will likely have follow-up questions once they receive your application, but you should be able to have your tax-exempt determination restored if your program is still 501(c)(3) qualifying.

5. Don’t Risk Having Your 501(c)(3) Status Revoked Again

Ideally, your nonprofit’s 501(c)(3) status will never be revoked. But if it happens, learn your lesson the first time around, and don’t let it happen again.

Maintaining proper compliance is more than a best practice recommendation—it’s a legal necessity. Failure to file Form 990 not only jeopardizes your tax-exempt status but also signifies a disregard for transparency and accountability to donors.

Get Expert Help Maintaining Your 501(c)(3) Status

The best way to never lose status is to keep complete, accurate financial records and file Form 990 with the IRS every year. This regular maintenance will always keep your nonprofit in good graces.

If you don’t have the time or resources to keep up with these requirements, reach out to Foundation Group’s team. From bookkeeping to compliance services, Foundation Group can take care of your nonprofit’s yearly filings so that you can focus on your mission. If you’ve already found yourself with Notice CP120A, it’s not too late! We work with dozens of revocations every year. Reach out today so we can help you, too.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

I HAD A 501C3 THAT WAS REVOKED FOR NOT FILING THE 990-PF. I SM LOOKING TO REINSTATE THE 501C3 BUT NOT AS A PRIVATE FOUNDATION BUT AS A PUBLIC CHARITY. CAN I JUST COMPLETE THE 1023-EZ AND NOT SELECT THE REINSTATEMENT BOX? I DID NOT RECEIVE ANY DONATIONS DURING THE 3 YEARS OF REVOCATION.

I’m afraid it is not going to be that easy. As the entity is revoked, you have to go through a reinstatement process, and since it was a Private Foundation, you also have to prove to the IRS that the organization would be better classified as a Public Charity.

Greg,

We filed our n-postcard with the IRS two years in a row during the pandemic and the IRS has no record of it. We also lost our treasurer and she has no record of it either. What should we do?

Hi Deanna, If the IRS has no record of the filing, and you don’t have any confirmation that it was filed, you need to file those as soon as possible to avoid automatic revocation of your exempt status. Hopefully, it was just the two years, and you aren’t facing three consecutive years of not filing. Hoping the best for you!

CEO of Heliopolis Akademeia Inc is retired tenured professor Menes R Guirguis .Due to the fact English is my fifth language adding to my extreme ignorance of regulations in the USS ,I hired my good friend who is a CPA but a little bit unorganized .From 2013 he filed form 990 nut IRS said they didn’t receive it.He resent copy of the invoices after revocation of status as charity 501 C3. The State of CA maintained the status butI held all activities from teaching critical languageS to counseling

He is procrastinating & IRS is loosing documents while I pay the consequences.How could you help for how much .All our financial budget is provided from CEO & Co-founder life savings .Income for the last 24 years is 0000 dollar.We donate from our tiny income

Dear Menes, We are sorry to hear of your situation, and unfortunately, it’s a story we hear rather frequently. To give you the best assessment, please call us at 615-361-9445. For more on our reinstatement process, see: https://www.501c3.org/501c3-services/reinstate-501c3-status/