Expert Tips for Beginners: How to Start a Private Foundation

If you’re passionate about a cause, you’re likely eager to take action and make a difference. While there are seemingly endless ways you could go about this, starting a private foundation might be the solution.

Although launching your own organization can allow you to make a long-lasting philanthropic impact, learning how to start a private foundation can be overwhelming since the process is so complex. In this guide, we’ll break down the essentials of private foundations to help you get started, including:

- Private Foundation FAQs

- How to Start a Private Foundation in 6 Steps

- How to Maintain a Private Foundation

As you explore this guide, formulate a plan of action to determine what next steps you need to take and consider how an expert in nonprofit formation can help. With that in mind, let’s get started.

Private Foundation FAQs

What Are Private Foundations?

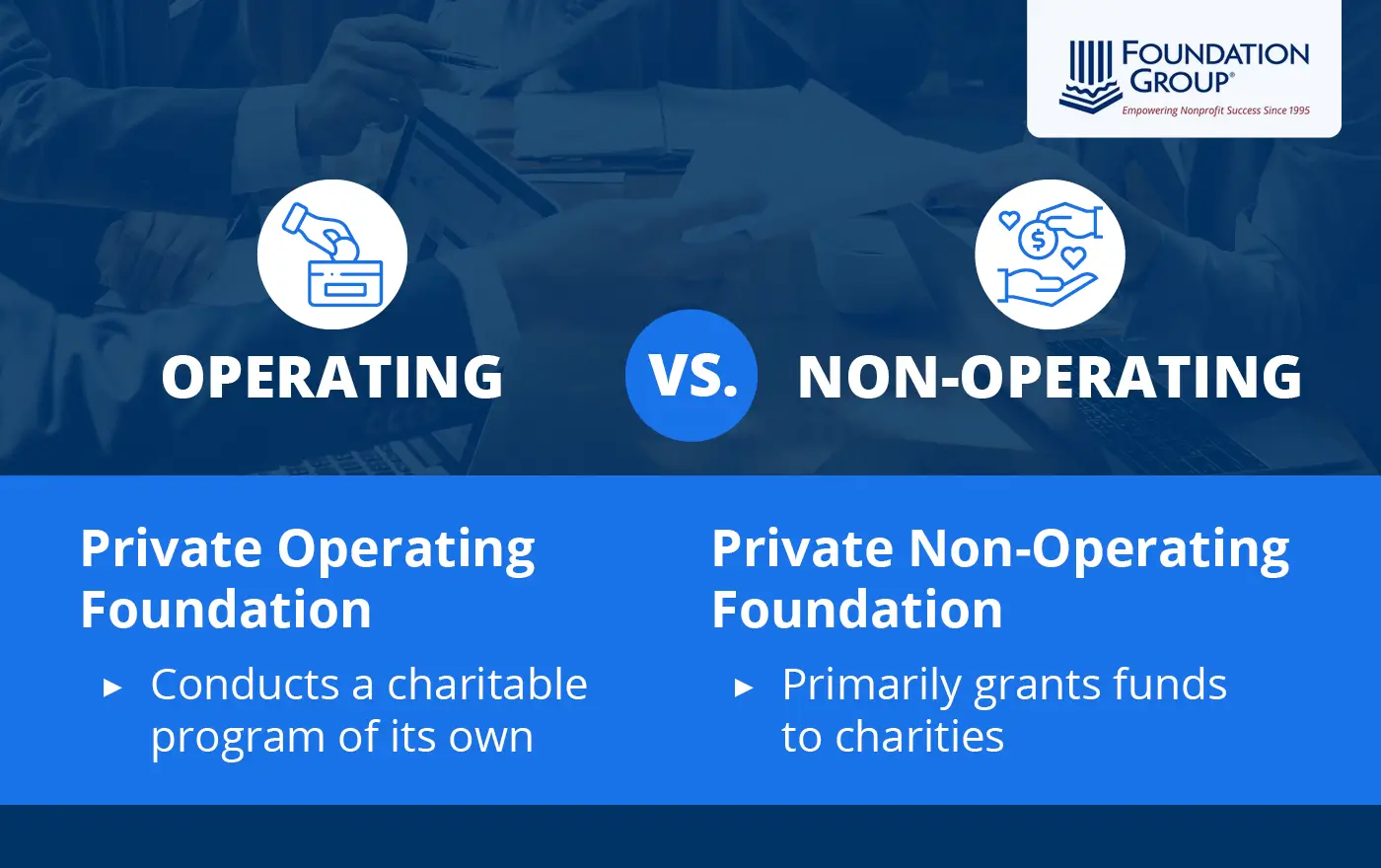

Private foundations are a type of 501(c)(3) organization usually established and funded by individuals or families (rather than having diverse governance and receiving public support.) There are two main types of private foundations:

- Private operating foundations, which follow the structure of a private foundation but conduct charitable programs of their own.

- Private non-operating foundations, which primarily grant funds to charities. This is the more common type, and the structure most people refer to when using the term “private foundation.”

Like any other 501(c)(3) organization, private foundations must be created for one of the charitable purposes defined by the IRS and must apply for tax-exempt status. In fact, it’s the default category the IRS assigns a nonprofit seeking 501(c)(3) status.

However, unlike other 501(c)(3) organizations, private foundations can be governed by a relatively closed group of individuals and don’t need to pass the public support test. There is no set amount of funding required to start a private foundation, but your organization may want to have enough to set up an endowment fund that can generate investment income to fund your grants.

What Do Private Foundations Do?

Since the majority of private foundations fall under the “non-operating” category, it’s clear that these organizations operate differently than traditional nonprofits.

Here’s a breakdown of how they typically work:

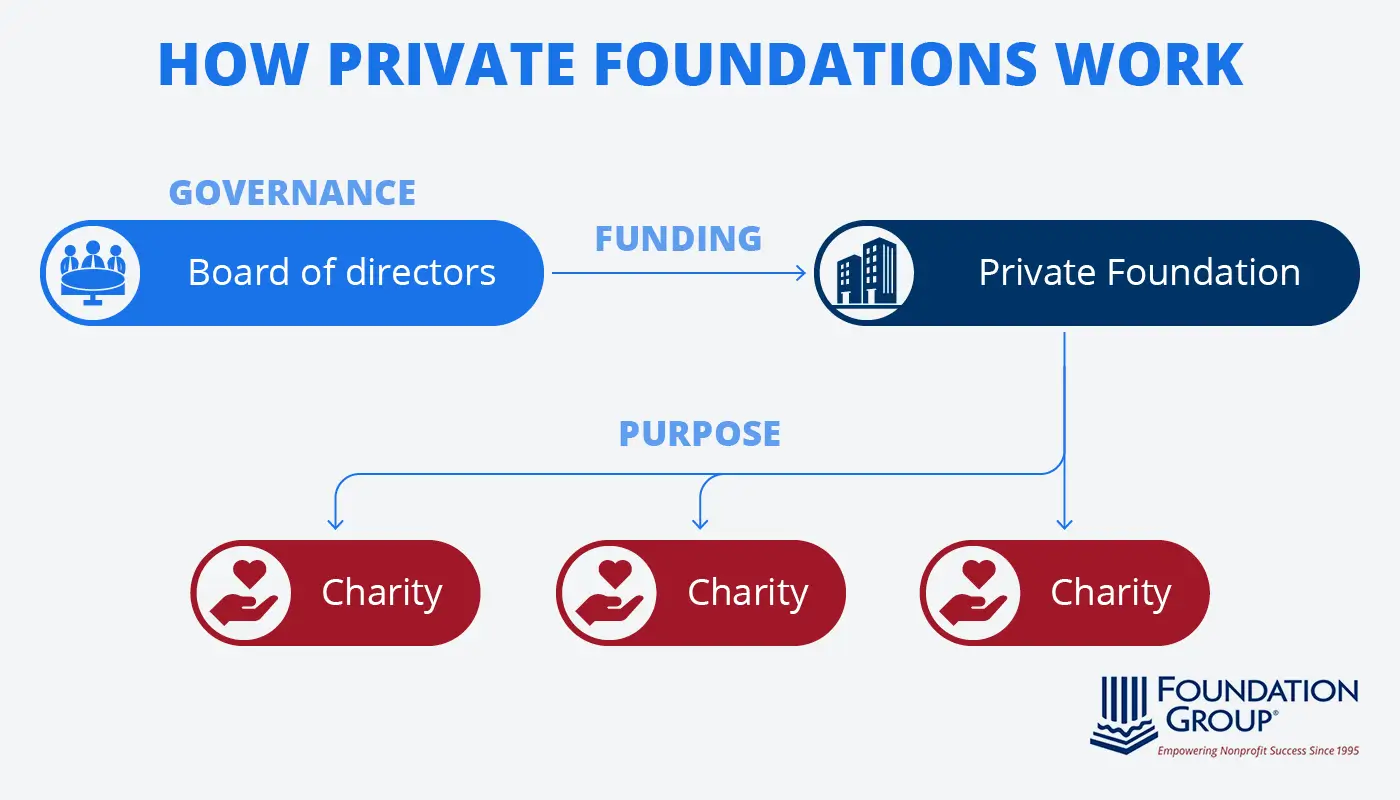

- Governance: Private foundations are usually governed by a relatively closed group of individuals, such as family members, business associates, or other closely connected people.

- Funding: Rather than soliciting donations from the public, private foundations receive funding from a small group of donors—sometimes just one.

- Purpose: With this funding, private foundations become philanthropic partners to charities. They provide funding to charitable activities through grants and other gifts.

While they only account for 7% of nonprofit organizations, private foundations provide nearly 25% of nonprofit revenue. So, if you’re looking to start a private foundation, you’re on the right track to fuel important charitable causes.

Why Start a Private Foundation?

There’s no automatic choice when it comes to starting a 501(c)(3) organization, but there are unique benefits to starting a private foundation if it aligns with your plans and intentions for the organization. These benefits include:

- Tax savings: Private foundation donors experience significant tax advantages. Not only are their donations exempt from state and federal estate taxes, but they may also avoid capital gains taxes by donating highly appreciated assets such as stocks or real estate. Donors can even receive an income tax deduction for the amount contributed of up to 30% of their adjusted gross income (AGI).

- The ability to leave a legacy: A private foundation provides significant support to important causes. Whether you start a private foundation to honor a loved one or in your family’s name to encourage a cohesive effort to make a difference, these organizations inevitably leave a lasting legacy on behalf of their donors and governing board.

- Greater control over support: Since private foundation donors typically govern the organization, they have the unique ability to choose how the foundation’s funds are invested and granted. As a result, these donors have greater control over the support they give.

Recent data shows that the average number and size of grants given by foundations increased from 31 to 33 and $25,000 to $28,000, respectively, from 2021 to 2022. Clearly, this small group of 501(c)(3) organizations is able to make a big impact in the mission-driven world.

How to Start a Private Foundation in 6 Steps

If your philanthropic plans line up with the priorities of a private foundation and you’re sold on the benefits listed above, the only thing left to do is to get started. Follow these steps to start a private foundation.

1. Define Your Purpose

Defining your foundation’s purpose is the first step in outlining its activities and how it should allocate grants. Ask yourself: Why are you starting a private foundation, and what will it accomplish?

Consult other potential private foundation donors to determine which areas your organization hopes to address. Reflect on your personal values and causes you care about to guide this discussion. Then, write out your agreed-upon purpose in a concise statement—you’ll need this later.

For example, a private foundation focused on the environmental health of its community might define its purpose as environmental education. This could include supporting educational programs that teach community members about conservation and sustainability. Of course, private foundations can have more than one related purpose—for instance, this example foundation could support climate advocacy in addition to education.

2. Create Your Governing Documents

Once you know what your private foundation will be about, it’s time to lay out how you’ll accomplish your goals. This foundational step in starting a private foundation is like the roadmap to fulfilling your purpose—the governing documents you compile will lay out how you’ll do what you want to do.

Plus, some of these documents are required to obtain 501(c)(3) status from the IRS, including your foundation’s:

- Mission statement: When you’ve determined the core focus of your private foundation, write it out in a concise mission statement. This statement should reflect your vision for the organization and outline its areas of focus. Later on, your mission statement can help guide your decision-making and strategic planning for the foundation.

- Bylaws: Once you have a clear outline of the organization’s purpose, it’s time to set your private foundation’s constitution. Bylaws outline how your private foundation will be governed and establish its operational procedures. This includes defining the composition, powers, duties, election process, and terms of board members, as well as any rules regarding committees or officers.

- Grantmaking guidelines: As the core of their operations, private foundations must set clear guidelines for grantmaking. Ensure the process for awarding grants aligns with your foundation’s mission and ensures fair and consistent allocation.

For help during this process, consulting a nonprofit compliance expert can be extremely beneficial. Having access to their expertise and valuable guidance can ensure you do everything right the first time around and think through all of the necessary components to include.

3. Appoint Board Members

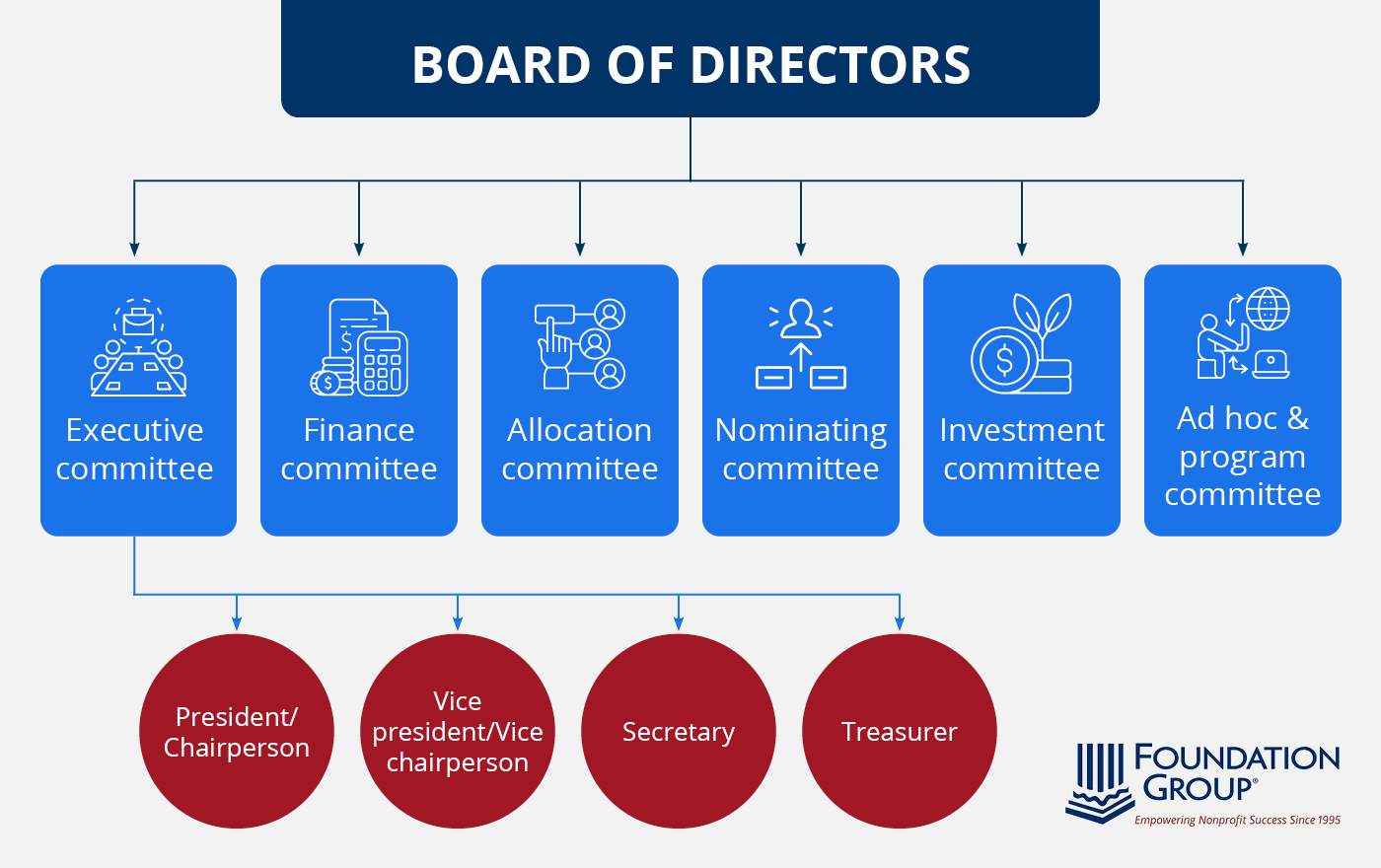

While a private foundation is typically led by a small group of donors, its governance structure may become more complex depending on its size and activities. Appoint board members and account for any committees, including:

- Executive committee, which includes the foundation’s leaders such as the president or chairperson, vice president or vice chairperson, secretary, and treasurer

- Finance committee, which oversees the foundation’s financial health

- Allocation committee, which recommends how funds should be dispersed among different programs

- Nominating committee, which identifies candidates for board membership or officer positions

- Investment committee, which manages the foundation’s investment portfolio

- Ad hoc & program committee, which addresses any issues or conflicts as they arise and runs the foundation’s programs if it’s an operating foundation

Assigning board duties will help your private foundation keep up with any necessary recordkeeping or tax returns, although expert guidance can be helpful for these tasks, as well.

It should also be noted that many smaller foundations will not have need for this type of committee structure, particularly if the governance board is made up of a handful of family members, for example. In cases like this, it is important, however, for the board to understand that it will have to operate in all of these capacities, as these areas of concern are pretty universal to successfully operate a foundation.

4. Apply for an EIN

Your private foundation’s federal Employer ID Number (EIN) is the numeric identifier assigned to your nonprofit by the IRS. You can apply for and receive your EIN through an online application. After obtaining it, you’ll also receive an EIN confirmation notice, which you should download for your records.

5. Incorporate Your Nonprofit

When starting a 501(c)(3) organization of any kind, you must create a legal entity. There are two main types of entities often considered when aiming to operate as a private foundation: trusts and corporations.

A nonprofit corporation is overwhelmingly the most common structure for private foundations. In this structure, your organization answers to its members and follows strict operating procedures to ensure it fulfills its charitable purpose. Additionally, incorporation limits personal liability for your organization’s officers and directors.

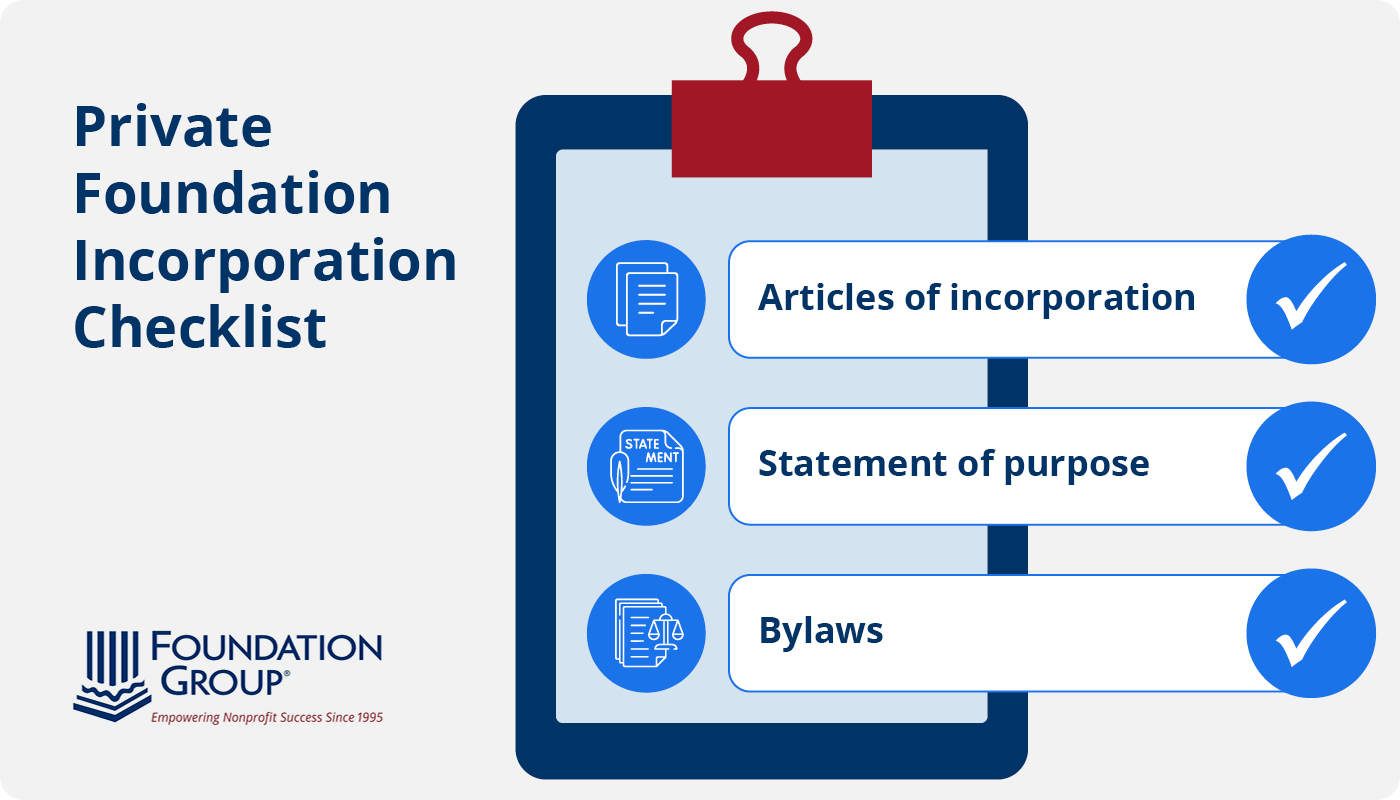

A proper approach to nonprofit incorporation requires the following:

- Articles of Incorporation: To formally establish your private foundation as a corporation, you must submit Articles of Incorporation to your state’s Corporations Division. This serves as your organization’s leading legal document and must include the required provisions under Section 501(c)(3) of the Internal Revenue Code (IRC), such as a statement of indemnification and charitable dissolution clause.

- Statement of purpose: Remember the very first step in starting a private foundation—defining your purpose? This statement clearly lays out the purpose of your private foundation and is helpful for securing 501(c)(3) status. Most states require this statement to be included in your Articles of Incorporation, but it’s important to have on hand regardless of your state’s requirements since it helps to guide your private foundation’s goals.

- Bylaws: As mentioned earlier, your bylaws are your organization’s operating rules. They’re meant to guide your internal operations and won’t actually be submitted with your Articles of Incorporation, but they’re an essential part of defining your foundation’s governance. While there may be state law requirements regarding the provisions included in your private foundation’s bylaws, federal tax law does not require any specific language.

Incorporation provides many advantages and is often the preferred structure for private foundations, though there are other possibilities, including trusts. Between navigating your state’s requirements and properly formulating your organization’s governing documents, it can be beneficial to enlist the help of an expert incorporation service.

6. File For Tax-Exempt Status

Once you’ve obtained your EIN and completed the incorporation process, you’re ready to file for tax-exempt status by filing IRS Form 1023. This form serves as an examination of your private foundation’s governing structure, purpose, and planned programs to ensure the organization is set up properly to fulfill its charitable purpose.

The form alone is 28 pages long, not including the required attachments and schedules that can often make these submissions up to 100 pages. It’s extremely important that you include everything required and file Form 1023 accurately in order to be approved. If you haven’t consulted a compliance expert by this point in the process, now would be a good time to do so.

How to Maintain a Private Foundation

Private foundation funding is certainly more flexible than that of other 501(c)(3)s, but these organizations must still follow specific rules to comply with the IRS’s guidelines. Failure to follow these rules can jeopardize your 501(c)(3) status, so you must familiarize yourself with compliance requirements to keep your foundation up and running.

The IRS lists the following requirements that apply to all 501(c)(3) organizations, including private foundations:

- Refrain from participating in the political campaigns of candidates for local, state, or federal office and may generally not engage in substantial lobbying activities.

- Ensure that its earnings do not inure to the benefit of any private shareholder or individual.

- Do not operate for the benefit of private interests such as those of its founder, the founder’s family, its shareholders, or persons controlled by such interests.

- Do not operate for the primary purpose of conducting a trade or business that is not related to its exempt purpose.

- Private foundations cannot have purposes or activities that are illegal or violate fundamental public policy.

However, there are other regulations unique to private foundations that your organization must follow. Once you’ve started a private foundation, maintain it by following these essential rules.

Annual Minimum Distribution

The IRS requires private foundations to spend (or distribute) a certain amount of money for charitable purposes. The generally accepted rule calls for 5% of the foundation’s financial assets to be distributed, and the result is often close to this number. However, the formula is much more complicated than that.

The annual minimum distribution amount is calculated by determining the foundation’s distributable amount, which is equal to its minimum investment return with certain adjustments. This amount must be distributed as qualifying distributions, and any distributions that exceed this amount may be rolled over for a period of five years to offset future distribution amounts.

Failure to disperse the distributable amount in a timely manner may result in a 30% excise tax on the undistributed income.

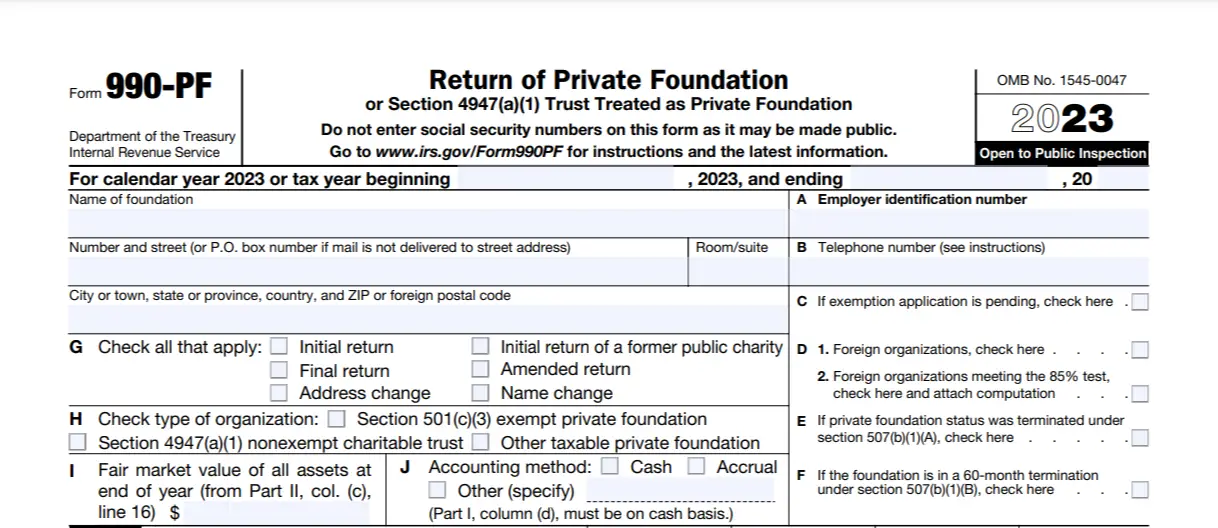

IRS Form 990-PF

Private foundations, like all other 501(c)(3) organizations, must file a tax return each year. However, foundations have their own version of the typical return: Form 990-PF.

The 13-page Form 990-PF must be filed each year, regardless of a private foundation’s size or revenue. This form requires private foundations to disclose their revenue and expenses by category, giving considerable attention to investment earnings and capital gains.

Also, because of the Annual Minimum Distribution requirement, private foundations must report their expenditures for charitable purposes on Form 990-PF. Part X of the form calculates the minimum investment return and Part XI uses this information to calculate the distributable amount.

Restrictions on Self-Dealing

While their ability to be funded and governed by a closed group of individuals affords private foundations much financial flexibility, they’re still bound by strict rules governing conflicts of interest. In fact, private foundations must adhere to even stricter rules regarding self-dealing than most nonprofits, especially when it comes to employment or business dealings.

Final Thoughts on Private Foundations and Public Charities

Starting a private foundation requires a thorough understanding of the organization’s structure and a well-planned strategy for fulfilling your mission. Consulting a compliance expert is a surefire way to ensure your organization is set up for success, and remains successful over the long term.

For more information on fulfilling your mission and maintaining compliance with the regulations set out by the IRS, check out the following resources:

- Private Foundation vs. Public Charity: Spot the Difference. There are numerous ways to make a difference, and you should understand the difference before starting a private foundation to make sure your approach best aligns with your mission. Check out the differences between private foundations and public charities in this guide.

- Hiring a Board Member in a Private Foundation. Hiring a board member is tricky for nonprofits, but even dicier for nonprofits that are private foundations. Learn more about how to hire an insider for your private foundation in this guide.

- Nonprofit Bookkeeping Services. In addition to starting your private foundation, Foundation Group can help you maintain it over time by keeping accurate records and supercharging your financial compliance. Explore Foundation Group’s services here.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!