The Best Guide to Bookkeeping for Nonprofits: How to Succeed

Your nonprofit has important work to do, but limited resources to do it with. To fulfill your mission and impact the communities you serve, you have to raise and allocate funds wisely—That’s why bookkeeping for nonprofits is an essential part of what you do.

Accurate bookkeeping can help your nonprofit manage its finances wisely and maintain nonprofit compliance. This guide will review everything you need to know about nonprofit bookkeeping to adjust your approach and get your books in line:

- What is Bookkeeping for Nonprofits?

- Nonprofit Bookkeeping vs. Accounting

- How to Start Bookkeeping for Nonprofits

- What Does a Nonprofit Bookkeeper Do?

Once you learn how to handle your bookkeeping needs, you can get back to the reason your nonprofit was started: your mission. Let’s start with the basics.

What is Bookkeeping for Nonprofits?

Think of bookkeeping as studying for a test—it’s the necessary first step you must take to prepare yourself for the big exam. In the same way, bookkeeping can prepare your nonprofit’s financial records and budget for tax filings, annual reports, and every other deep dive into your assets.

Bookkeeping for nonprofits is recording and analyzing financial transactions to ensure compliance with state and federal accounting rules.

In other words, effective bookkeeping practices will accurately record and monitor your financial activity throughout the fiscal year. When the time comes to report your financial activity or make a budgetary decision, you’ll be equipped with precise and thorough information. That way, you can be sure that your nonprofit maintains both its 501(c)(3) status and the trust of its supporters.

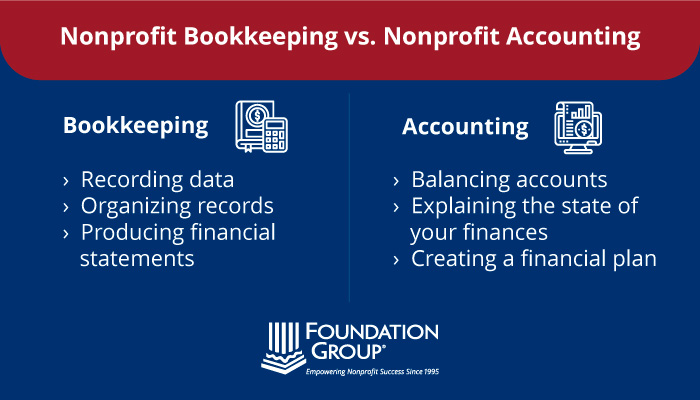

Nonprofit Bookkeeping vs. Accounting

If you’ve researched bookkeeping tips before, you may have seen the terms “bookkeeping” and “accounting” used interchangeably. But these roles are very different, and it’s important to understand the difference before you tackle bookkeeping for your nonprofit:

Bookkeeping focuses on the following roles:

- Recording data: Bookkeeping involves entering data into your nonprofit’s bookkeeping solution (whether that be a spreadsheet or a designated bookkeeping software). This data includes donations, expenses, and any other transactions your nonprofit makes.

- Organizing records: Not only does bookkeeping ensure all your data is recorded, but it also helps keep your financial data organized by categorizing each donation and expense.

- Producing financial statements: Budgets are helpful for internal financial management, but bookkeeping can also give you the information you need to create financial statements for an overview of your financial activity. If you choose to outsource your nonprofit’s bookkeeping, a professional will create these statements for you.

In contrast, nonprofit accounting involves analyzing your nonprofit’s financial information and creating a financial plan accordingly. Specifically, accounting entails:

- Balancing accounts: Your nonprofit’s accountant will check behind your bookkeeping system and review your records to ensure there are no errors or discrepancies.

- Explaining the state of your finances: Accounting involves analyzing the current financial situation and explaining it clearly while providing actionable next steps for budgeting.

- Creating a financial plan: Using financial data from previous years, nonprofit accountants estimate future projections and can help your nonprofit come up with a plan for better allocating its funds.

Essentially, you should view bookkeeping as the financial oversight process that’s necessary for operating your nonprofit daily. For example, bookkeeping ensures your nonprofit uses its revenue wisely and maintains its tax-exempt status. Accounting, on the other hand, is using that information to provide a detailed analysis of your finances.

How to Start Bookkeeping for Nonprofits

Once you have a clear understanding of what nonprofit bookkeeping entails, you can create a plan to get started with your bookkeeping efforts! The good news: you can start bookkeeping in five simple steps:

1. Find a bookkeeper

Nonprofit bookkeeping is a nonnegotiable task—it just has to be done. You can either assign this task to one of your staff members or trust a professional to handle it.

While no certifications are necessary to manage your nonprofit’s bookkeeping, the right individual for the job will have the following qualifications:

- Familiarity with bookkeeping software: A digital platform can greatly streamline the recordkeeping process, but it’s not as convenient if you have to train your staff members on how to use the software. If you’ve invested in a platform to help organize your financial data, make sure that the bookkeeper you’re considering is familiar with the tool. At Foundation Group, our bookkeepers are not just familiar with bookkeeping tools, but they’re QuickBooks ProAdvisor certified. We even provide a substantial ProAdvisor discount to our clients.

- Understanding of state and federal rules: A bookkeeper can’t maintain your nonprofit’s compliance if they don’t know the rules that regulate your organization! Professional bookkeepers have seen it all—from the federal laws that your nonprofit must follow to your state’s unique rules. They’ll also know how to manage your compliance if you operate in several states, such as the requirements for your charitable solicitations registration.

- Experience in nonprofit finances: Not only should your bookkeeper know how to maintain compliance, but they should also be well-versed in nonprofit accounting best practices. Between tax deductibility, different donation categories, and the unique rules around raising revenue, nonprofit finances are completely different from that of any other organization. The person you trust with your books should know that and be experienced in handling this type of budget.

It’s also important to recognize that bookkeeping is not a part-time job. Adding this responsibility to an existing staff member’s to-do list will likely overwhelm your employees, and your books won’t get the undivided attention they need. That’s why your first step in the bookkeeping process should be finding a bookkeeper (and evaluating your outsourcing options).

2. Record every transaction

Whether you spend one dollar on paper clips or $1,000 on a venue for a fundraiser, every transaction must be recorded. To do this, have your bookkeeper monitor and record your transactions or invest in a software solution that automatically tracks each expense for you.

Your recordkeeping must be as detailed as possible. This information will be used later to produce financial statements (and report your financial information to the IRS), so you should thoroughly and accurately detail each transaction your nonprofit makes.

For example, let’s say your nonprofit needs a car to run errands for the organization. A generous car dealership gives you a vehicle for free, but that doesn’t mean it wasn’t a transaction! You’ll need to record the car as an in-kind donation from the dealership, noting even details about the model and make of the vehicle.

3. Reconcile your bank statements

Just like you’d check your personal bank account against your receipts, reconciliation involves comparing your nonprofit’s bank statement to its records. By making sure your transactions line up with your records, you can:

- Identify any discrepancies: Whether someone mistyped a number or a transaction was left out of your records, reconciliation can catch these accidental mistakes before they throw all your financial data off.

- Rectify budgetary errors: Instead of learning about an error after the mistake has been made, bank reconciliation can help your nonprofit find issues and fix them before facing the consequences. For example, inaccurate records might show that you have more money than you actually do. Identifying this issue can prevent your account from being charged an overdraft fee when a monthly bill is automatically taken from your account.

- Catch fraudulent activity: If your nonprofit experiences fraud, account reconciliation can identify it early enough to where the situation can be fixed. Regularly checking your account can even deter fraudulent activity, since all your employees will know that you’re keeping a close eye on your records.

The more transactions your nonprofit makes, the more often you should reconcile your bank statements. You might start by reconciling every time you receive a bank statement (usually once a month), then schedule additional time as the size and quantity of your transactions grow.

4. Make a budget

Think about your budget like a roadmap to where you’ll spend your money. You have to know the area to plan a route, and the same can be said about your nonprofit’s budget. Accurate and timely bookkeeping practices will make the job of those tasked with budgeting much easier to tackle.

Using the details you recorded about your nonprofit’s transactions, create a broad overview of your financial position and develop a plan to get your revenue where it’s supposed to be. To do this, you’ll need to set reasonable expectations for your income, expenses, and financial goals. Then, plan out how you’ll spend your income in a way that achieves those goals.

5. Create financial statements

Your bookkeeper should produce the following statements based on your nonprofit’s financial activity:

- Statement of Activities: Reports where revenue came from and how it was used as well as expense activity

- Statement of Financial Position: Identifies available assets and how they should be allocated, as well as liabilities owed and the resulting net funds balances

- Statement of Cash Flows: Reports cash receipts and disbursements coming in and out of the organization

These financial statements can provide helpful insight into your nonprofit’s financial health so that you can adjust accordingly and plan your next moves.

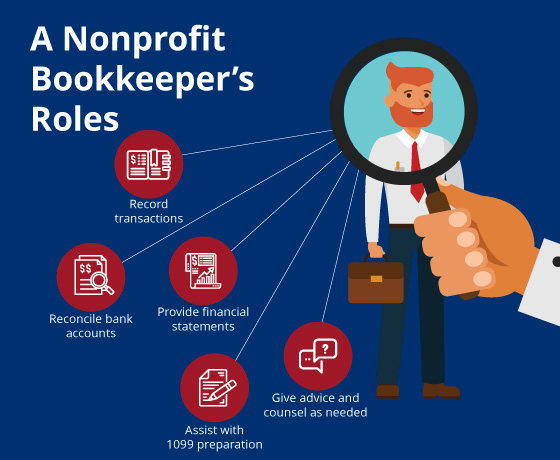

What Does a Nonprofit Bookkeeper Do?

If you’re ready to get started with step one of the bookkeeping process, let’s jump right in by recapping a nonprofit bookkeeper’s responsibilities:

- Record transactions

- Reconcile bank accounts

- Provide financial statements

- Assist with Form 1099 preparation

- Give advice and counsel as needed

Your bookkeeper might provide more services, but you can use this list as a starting point for your expectations. You should know what you need from a bookkeeper before you can choose a professional to go with—after all, they can only support your goals if you know what your goals are!

Ultimately, a nonprofit bookkeeper should help your organization achieve the following goals:

- Compliance with IRS requirements

- Easily accessible financial records

- Clear and understandable financial statements

No one knows your nonprofit better than you do, which is why you should hire a professional bookkeeper to get your records in order and leave the decision-making up to your organization’s leaders. And, if you need further advice, an experienced bookkeeper can give you their perspective on your budget.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!