When most people think of a nonprofit, a public charity is usually the first type of organization that comes to mind. But there’s another type of nonprofit that plays a less visible, yet absolutely essential role in charity and philanthropy: the private foundation.

In this guide, you’ll learn all you need to know about what a private foundation is and how to maximize your philanthropic impact by starting one, including:

Private foundations make up only 7% of nonprofit organizations, but they provide nearly a quarter of nonprofit revenue—and that number is growing. If you’re ready to tap into this form of philanthropic impact, read on to learn more.

What Is a Private Foundation?

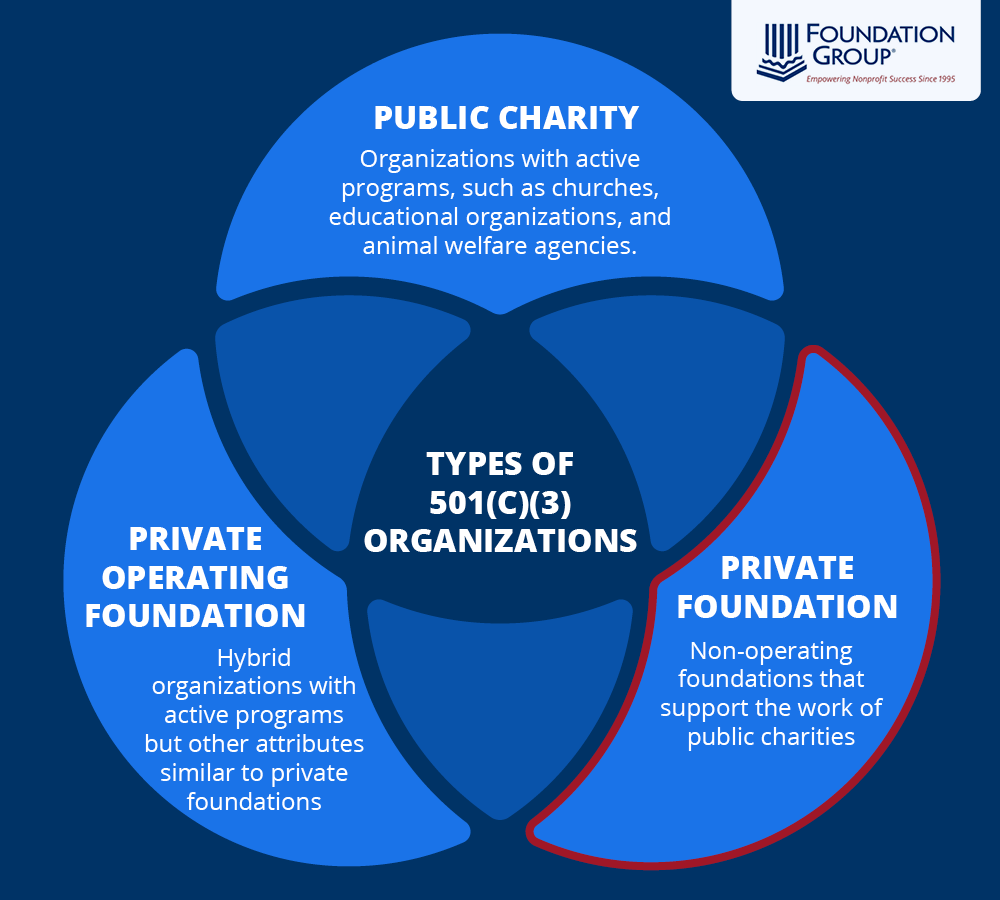

A private foundation is a type of 501(c)(3) organization, usually established for the purpose of granting money to charitable causes. It’s the default category the IRS assigns a nonprofit seeking 501(c)(3) status, unless the applicant has requested and demonstrated suitability for public charity status.

Private foundations typically refer to non-operating foundations, which are distinctive from operating foundations (More on this later!).

How Does a Private Foundation Work?

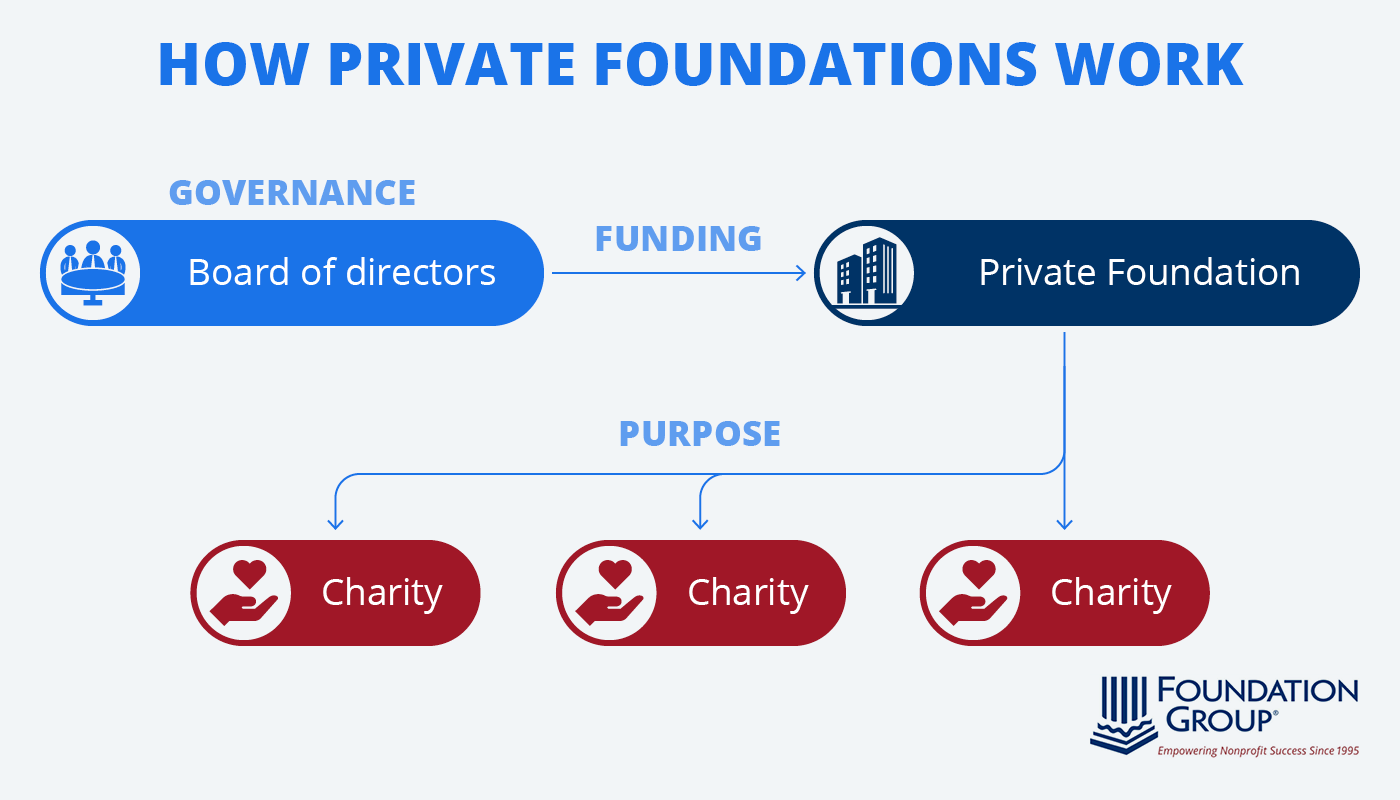

There are three distinct characteristics that define how private foundations work:

- Governance: A private foundation, like most nonprofits, is governed by its board of directors. What makes a foundation unique is its ability to have a relatively closed group of individuals overseeing it. This may include family members, business associates, key donors, or other related people. For example, the Smith Family Foundation can be exclusively formed, governed, and managed by members of the Smith family and still maintain IRS and state compliance.

- Funding: Private foundations are often funded by a small group of donors—sometimes as few as one. The IRS requires public charities to have a diverse base of public support, but this regulation doesn’t apply to private foundations. In fact, it is somewhat the exception to see a private foundation seeking outside donor support.

- Purpose: Most private foundations are established to fund charitable activities through grants and other gifts. Foundations give an average of 33 grants annually to charities, and this number is on the rise. The average grant size is rising, too, increasing from $25,000 to $28,000 in recent years. While private foundations can operate their own programs, most choose not to. Instead, they serve as philanthropic partners to charities, providing a crucial source of funding necessary for charitable programs to be successful.

Private foundations are different from other types of 501(c)(3)s in several ways, but notably, they experience more funding flexibility than public charities. Nothing prevents a foundation from fundraising and growing its donor pool, but nothing requires it, either. This close-funding situation often plays out in family foundations, where the family itself provides the only significant funding coming into the organization.

What Are the Different Types of Private Foundations?

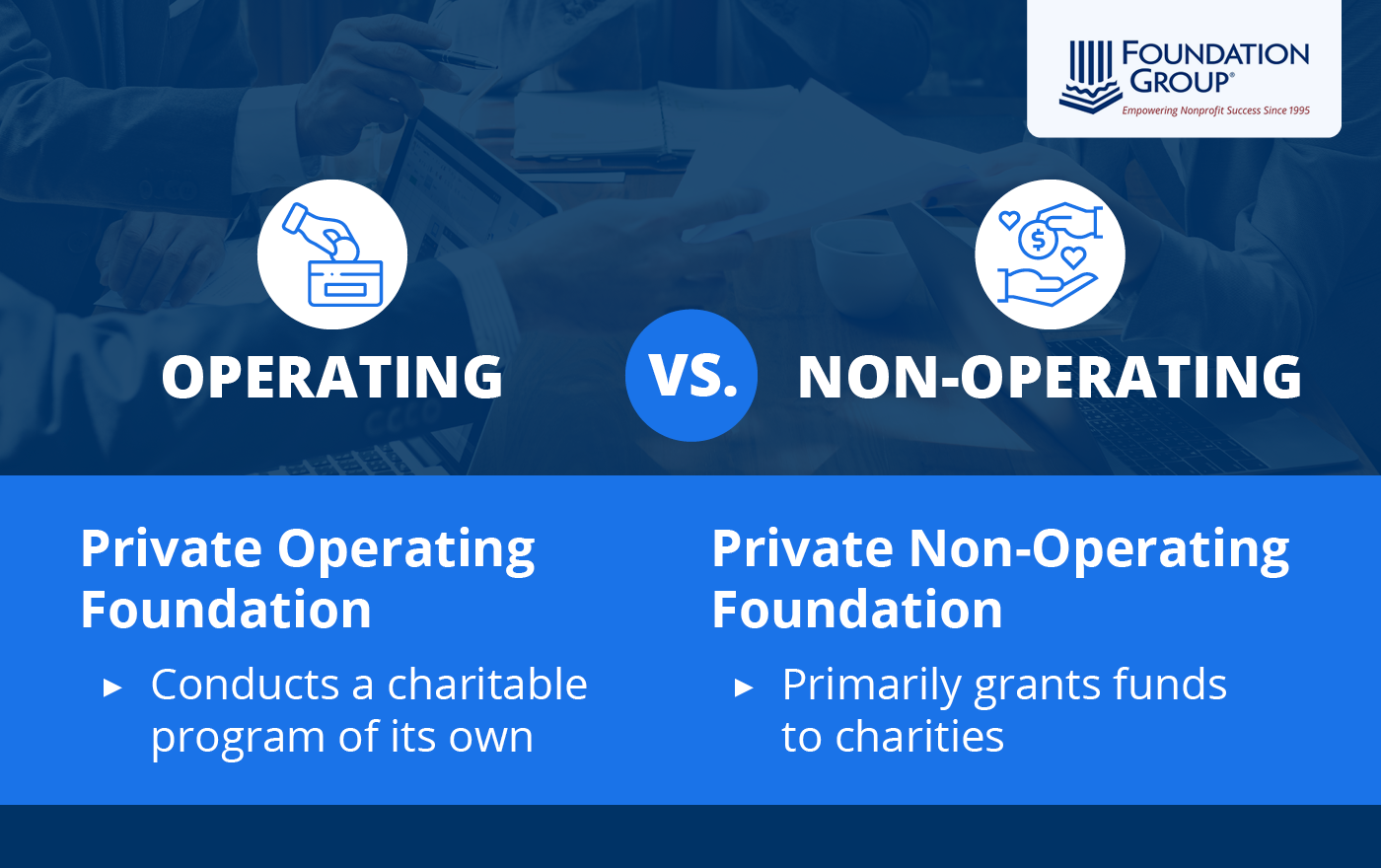

Every 501(c)(3) organization is classified by the IRS as a private foundation or a public charity. However, private foundations can be broken down into the following two categories:

- Private operating foundation: Unlike a typical private foundation, a private operating foundation conducts charitable programs of its own, much like a public charity does. The IRS doesn’t call this a hybrid of the two designations, but in practice, that is a reasonable description. This narrow category of 501(c)(3) has strict rules that govern its operations and money flow. Qualifying for this status is challenging, but it may be ideal for those nonprofits needing the close-governance ability of a foundation and preferring the operational nature of public charity.

- Private non-operating foundation: Accounting for 91% of foundations in recent years, private non-operating (or grantmaking) foundations primarily grant funds to charities. This common type of foundation is typically established with a significant endowment from a family or an individual. When organized by a family, the foundation represents the family’s assets and interests, while an independent structure is managed by an independent benefactor.

For example, compare the Bill & Melinda Gates and Ford foundations. The Bill & Melinda Gates Foundation is considered a private operating foundation because of its various initiatives, including its global health and development programs. The Ford Foundation, by contrast, focuses its efforts on grantmaking and offers funds to organizations fighting numerous inequalities.

What Are the Benefits of Private Foundations?

If you’re passionate about a cause, you may wonder why you should provide grants through a private foundation instead of diving into the work with a public charity. However, private foundations have a high potential to impact causes and provide significant benefits to donors.

Private foundation donors experience significant tax advantages, including:

- Estate tax savings: Money donated to a private foundation is exempt from state and federal estate taxes because it isn’t included in the donor’s estate.

- Capital gains savings: Donations of highly appreciated assets (like stock or real estate) to a private foundation may allow donors to avoid capital gains taxes.

- Income tax savings: Donors to private foundations may receive an income tax deduction for the amount contributed of up to 30% of the donor’s adjusted gross income (AGI).

Additionally, private foundation donors have greater control over their charitable giving since they get to choose how the foundation’s funds are invested and granted. These donors are also free from constant donation solicitation since private foundations don’t depend on the public to fund their missions.

Private Foundation Rules

Annual Minimum Distribution

Each private foundation is required by the IRS to distribute a minimum of 5% of its average net investments each year. This is true even in years where the foundation experiences no additional income or investment return. Distributions that satisfy the 5% criteria include gifts and grants to charities and administrative costs associated with these activities. Also, qualifying distributions in excess of 5% can roll forward to help offset the distribution requirement of the next year.

IRS Form 990-PF

All 501(c) organizations are required to file Form 990 each year with the IRS. This particular filing amounts to a nonprofit’s annual tax return. For most nonprofits, there are three versions that could be filed:

- Form 990-N

- Form 990-EZ

- Form 990

The version filed usually corresponds with the organization’s gross revenue. However, private foundations have their own version of this return: Form 990-PF. All private foundations must complete and file Form 990-PF each year, regardless of size or revenue.

Restrictions on self-dealing

All nonprofits should avoid conflict-of-interest situations whenever possible. Most states and the IRS have strict rules governing how those in control financially interact with an organization, especially when it comes to employment or business dealings. This is especially true with private foundations, as the control and governance flexibility afforded private foundations come with stricter rules regarding self-dealing.

How to Start a Private Foundation

If you decide to start a private foundation, you’re embarking on a journey of philanthropy that can impact communities for good and establish a charitable legacy for years to come. There are four steps you must follow to head down this path:

- Define your purpose: When starting a 501(c)(3) organization of any kind, you must define the organization’s charitable purpose. This should outline the cause your foundation will support and the impact you hope to achieve, and it should be reflected in your foundation’s mission statement.

- Apply for an Employer Identification Number (EIN): Your EIN is the unique identification number assigned to your organization by the IRS. This number is required for tax and reporting purposes, so applying for one is a key step in the startup process.

- File for tax-exempt status: File Form 1023 with the IRS to apply for tax-exempt status for your foundation. This application can be complex, so it may be helpful to work with a compliance expert when compiling the information you’ll need for the form.

- Maintain that status over time: Once your private foundation is up and running, you’ll have to maintain compliance with IRS regulations to continue supporting your mission. This involves completing your annual tax filing, following the private foundation rules discussed above, and meeting any other legal standards required of your organization.

For more than 25 years, Foundation Group has helped start and maintain private foundations. Our team members provide expert assistance and support designed to meet all of your structure and compliance concerns. From incorporation and 501(c)(3) foundation status to bookkeeping and IRS Form 990-PF compliance, our professionals have you covered.