How to Allocate Nonprofit Expenses

There are some universal truths when it comes to nonprofits that are not dependent on the size of the organization. This is especially true about money. While yes, the amount of revenue determine which Form 990 the nonprofit is required to file with the IRS, it does not change how the revenue and expenses should be properly accounted for.

Just like how donations and other forms of nonprofit revenue have specific reporting requirements, so do nonprofit expenses. And once again, these best practices are applicable to organizations of any size. What does that look like exactly? Dividing out your organization’s expenses into three main allocations: Program Service Expenses, Management and General Expenses, and Fundraising Expenses.

While anyone who files a Form 990 standard form (those with $200,000+ in gross revenue in a year) already knows what we’re referring to (and how nuanced it can get), these allocations should also look familiar to some state filers when it comes to filing their annual Charitable Solicitation Registration applications. About half of the states that require a Charitable Solicitations filing require that the totals of these specific allocations to be listed among the financials provided in the application.

At first glance, these allocations seem fairly self-explanatory. Upon further inspection, however, we’re reminded once again that the IRS is not always as clear as they appear to be. For example, what if you have a paid board member who spends a good portion of their time working on programs as opposed to administration? Or, what if you rent a space that functions as both a place to conduct your organization’s programs and as an office? It’s not so clear cut. Below, we’ll identify each of these expense allocations as well as common, multi-allocation scenarios.

As the name suggests, this allocation is dedicated to activities that further the organization’s purpose. Here, we’re talking about the organization’s exempt purpose as approved by the IRS. A straightforward example would be if your organization issued a grant or scholarship to another organization or person. However, portions of expenses can be and should be included in this allocation as well. For example, if you need to travel to conduct your programs, that would be included here. But the travel costs to get office supplies, on the other hand, would be included in the Management and General Expenses allocation.

While the allocation category itself is mostly self-explanatory, exactly how much of an organization’s expenses fall into this allocation was debated for years. Some of the nonprofit “watchdog” groups that many of you have come to recognize like Charity Navigator, Guidestar, and Better Business Bureau’s Wise Giving Alliance graded the donor-worthiness of a charity based on an overhead ratio. What was this magic ratio? 80% of expenses allocated to Program Expenses and 20% of expenses allocated to Management and General Expenses, known as the 80/20 rule and later the Overhead Myth.

While the concept itself seems like a great best practice at first glance, the result left many nonprofits afraid of stepping outside of this precise ratio to reinvest in themselves and improve their organizations. Fortunately, this notion received enough pushback in the early teens that Charity Navigator, Guidestar, and BBB issued a joint statement acknowledging the problems it caused. They also provided education on relying too heavily on any overhead ratio as a direct measure of success as well as encouraged nonprofits to not live so in fear of these ratios that they fail to adequately invest in their organizations.

That being said, most public charities should be spending more on their programs than administration costs in any given year, barring unusual circumstances.

This is where we see a lot of organizations list their expenses if they don’t know where to put them. This allocation relates to the organization’s overall operations and management, so it encompasses a lot of activity… but not everything. It’s important to keep in mind that this is purely for administrative costs.

You would include activities such as costs of meetings for the Board of Directors, different committees, or the staff, unless the meetings are specifically for programs services or fundraising activities. This allocation also includes line items such as general legal services (such as if you hired a company like Foundation Group), insurance, office supplies and management costs, filing costs, rent for an office, salaries, etc.

Some of those line items may seem obvious. But, once again, the total amount of say a person’s salary would not be listed in this category… but at the same time, it could be. It all comes down to the purpose of the money spent. We’ll discuss it further below.

This allocation is the most misleading in its nomenclature, at least on the Form 990. Yes, it encompasses the expenses incurred in soliciting cash and non-cash contributions, gifts, and grants, but it does not include the direct expenses of fundraising events. Instead, it lists indirect expenses of fundraising events such as advertising and promotions; preparation and distribution of fundraising manuals, instructions, and other materials; and any preparation to solicit and receive contributions.

However, when calculating the final total of your nonprofit’s Fundraising Expenses, direct expenses of the fundraising event still needs to be taken into account. This includes expenses such as food and beverages, invitations, rental space, and any other costs needed to actually conduct the event.

Ultimately, it is important to pay attention to what the form being completed is asking for to determine where the different line items for this allocation is listed, whether that’s on one of the Form 990s to the IRS or even a Charitable Solicitation application. It all contributes to the total.

Whenever we enter the realm of finances, it is never a one size fits all for every nonprofit organization. But there are some basic practices that hold true, and in this case, it’s all dependent on how the organization spends its money to achieve its exempt purpose. This will determine if the expenses fall into one, two, or three allocations.

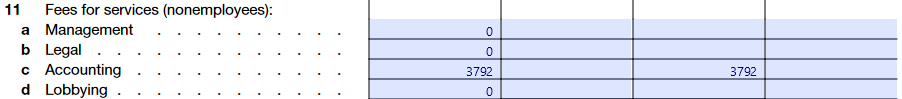

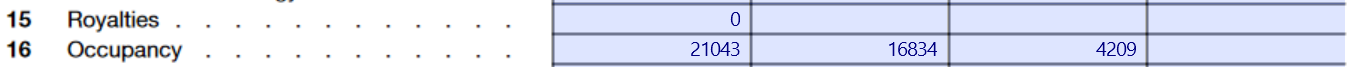

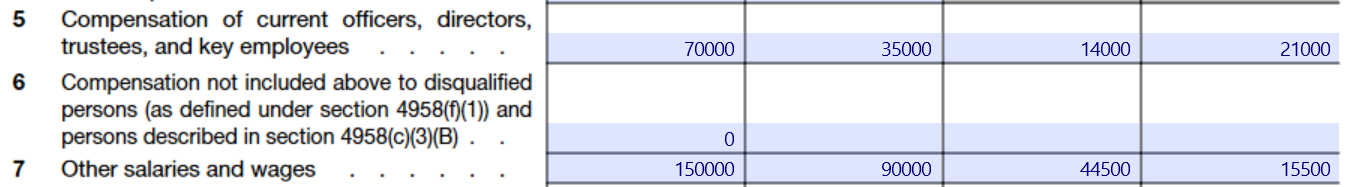

Important Note: In the below scenarios, the columns are in the following order: Total, Program Service Expenses, Management and General Expenses, Fundraising Expenses.

For example, if your organization decides to outsource its bookkeeping needs or have a volunteer dedicate their time to this nuanced task, the cost to pay for the company and/or any software needed, would be entirely allocated to Management and General Expenses. See below.

Now let’s get a little more complicated. As we presented earlier in the article, say your organization rents a space that functions as an office as well as where you conduct your programs. This is an extremely common scenario for animal rescues and shelters, albeit not limited to only these types of organizations. So what do you do? This is where you determine what percentage of the space is used for the program and administrative tasks. Sticking with the animal rescue, say 80% of the space and necessary upkeep is to conduct programs and the remaining 20% is used for office space. This is how that would look:

Last but not least is the question of salaries and all that come with it, such as insurance, payroll taxes, and any other employee benefits. This includes salaries to current officers or directors, potentially any disqualified persons, and any other paid staff. It’s important to keep these separated in your books. It’s also important to note that any of these people likely do more than just administrative tasks. If an officer or director is being paid, they are likely overseeing the programs being conducted as well as any fundraising events on top of maintaining any necessary administrative tasks. On the other hand, your organization may have people on staff for purely administrative purposes, such as a janitor, bookkeeper, or office staff. These salaries would be allocated solely to Management and General Expenses. Once again, you must determine the various people in your organization who are paid and what the purpose of their work is. Here is what these salaries can look like:

Nonprofit organizations have different needs and as a result have a wide range of possibilities for their expenses. However, that doesn’t change how nuanced and complicated the accounting can become. So whether your organization makes $10,000 in revenue a year or $1,000,000 in revenue, it is crucial to understand how your expenses are being allocated. At the end of the day, it is the board of directors who are individually held responsible to not only uphold the nonprofit’s exempt purpose but maintain the financial integrity of the organization they serve.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (2)

Comments are closed.

Hi – in regards to the fundraising costs… if you’re not listing the direct cost of the fundraising event (annual gala) under Fundraising Expenses, where would you list it? But you could list the cost of the marketing material for the gala under Fundraising Expenses? Just not the cost of the venue, food, decor, etc.? Am I reading that correctly?

That’s correct, Rebecca. It gets confusing, but direct costs are broken out on Form 990’s subschedule for fundraising activity, Schedule G. General costs associated with overall fundraising activity gets allocated on the P&L section of Form 990.