What is Form 990-EZ?

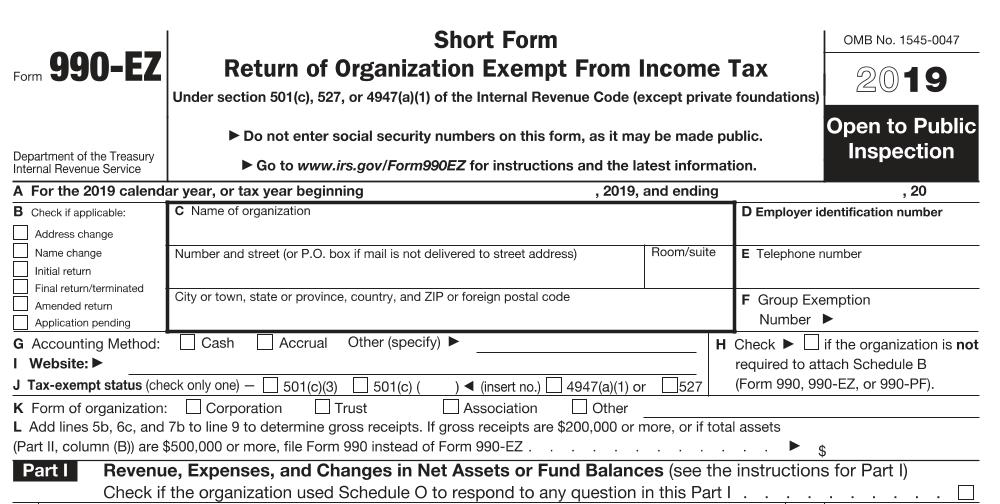

This article is the third in our series that explores the various versions of IRS Form 990. Form 990-EZ is annual information return filed by small-medium sized public charities and certain other nonprofits, at least as measured by gross revenue.

The name itself, Form 990-EZ, is somewhat of a misnomer. While it is certainly easier to prepare than other full-form variants, it is by no means easy. It is the lowest threshold version that really resembles a corporate tax return, only more thorough. The IRS is looking for all the demographic information contained in Form 990-N, plus:

- A full accounting of income and expenses by category

- Details on grants and distributions given by the nonprofit

- Balance sheet that aligns with the income and expense information

- Details about specific program accomplishments and associated expenses

- A list of current board members, their addresses, hours worked for the organization, and details regarding any form of compensation, whether cash or benefits

- Quite a few Yes/No/Explain type questions covering topics from conflict of interest to indoor tanning services (not kidding about that one!)

- Details regarding compensation of executive staff

- A breakdown of the sources of income over the past 5 years (or the life of the nonprofit, if operating less than 5 years)

- And, finally, details on any donors to the organization generally giving more than $5,000 during the past year

Like all versions, Form 990-EZ is due on the 15th of the 5th month, following the end of the fiscal year. There is a paper version of the form which may be filed by mail, as well as the ability to file electronically with the IRS (which they prefer). A six-month extension is available by filing IRS Form 8868 by the original due date of the return.

Another stipulation, and the most important one, is the associated revenue and asset-valuation thresholds. In order to qualify to file Form 990-EZ, a nonprofit should have gross income of more than $50,000, but less than $200,000 during the past fiscal year. In addition, the total valuation of all assets should be less than $500,000. If an organization’s assets are worth more than that, a full Form 990 will be required, regardless of revenue.

A question we encounter rather frequently involves nonprofits with annual gross revenue that tends to hover right around the lower or upper end of the range, often jumping back and forth across the line from year to year. In most cases, it is considered best practice to file up and stick with that choice. In other words, if a nonprofit usually finds itself liable for Form 990-N some years , and Form 990-EZ in others, stick with Form 990-EZ every time. The same holds true for organizations at the upper end. File the full Form 990 every time.

Why? It’s never wrong to err on the side of more disclosure and more transparency. Plus, if your nonprofit finds itself liable for the longer version in alternating years, it’s usually better for your board, staff, and third-party compliance providers to have a consistent preparation and filing experience each year. You may not be legally required to follow this advice, but it’s still good advice!

If you need assistance with Form 990-EZ, or any other version, be sure and let us know. We’re here to help.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (10)

Comments are closed.

I am under the impression that a church (nonprofit) is not required to file a 990 form. Is that correct?

That is correct.

I have had my 501c3 for 7 plus years and never used it until now…what do I need to do??????

The question isn’t so much whether or not you’ve “used it”. Have you filed Form 990-N each year? If you’ve missed three years in a row, the IRS has already revoked your 501(c)(3) status, requiring you to reapply to get it back. We work with dozens of such reinstatements each year, so if you need help, let us know.

The 501(c)(3) I volunteer with is a church. The IRS told us years ago that no matter how much money comes our way we are tax-exempt. Does this 990-N or EZ include churches?

All 501(c)(3) organizations are deemed tax-exempt, but most have to file some version of Form 990 each year. Churches are the notable exception, and are not required to file Form 990.

Thank you! When I accepted the role of treasurer I learned that no forms have been filed in 25 years. We are still very small with very little income and no paid employees. Thank you for confirming.

Hello, We are a newly formed 501(c)3 organization (4/15/19) in CA. Our program Single Mothers Student Success (SMSS), provides a supportive environment and resource connections to low-income single mothers pursuing their educational goals and financial independence. Our website and program will be ready to launch in mid February 2020. However, our Board Secretary just resigned on 1/30/20 due to other pressing family obligations. Our Board use to consist of (5) members and now we are down to (4). Our CFO has graciously agreed to be our temporary secretary, serving the board in two dual-roles. How would I list this dual-role on our website now that we do not have a secretary? Or better yet do I have to…when it will be apparent that role of secretary is vacant on our website?

If you’re CFO is going to fill that role temporarily, go ahead and post him/her as the Secretary. It’s OK to acknowledge that they are filling both roles.

Hello Greg:

I came across a discussion on a different blog post while doing a Google search…but the comments section is closed. Hope you don’t mind if I run something by you here.

Please see this previous comment you made for reference.

https://www.501c3.org/how-to-pay-your-nonprofits-staff/#comment-15988

Would it be possible to elaborate in more detail on this matter of an employee deferring compensation until a later date when the organization might be on better footing.

Also, I know California (and maybe some other states) allow for one person to incorporate the organization and form a one person board. Are these individuals allowed to earn a salary and/or defer salary until a later date? Or is this precluded?

I always assumed one person organizations were allowed to compensate their founder…but your comment gave me pause that perhaps I misunderstood the implication. Perhaps, it is only okay for one person to form/serve on the board so long as they are not being compensated.

Thank you.