Recordkeeping Basics for Nonprofits

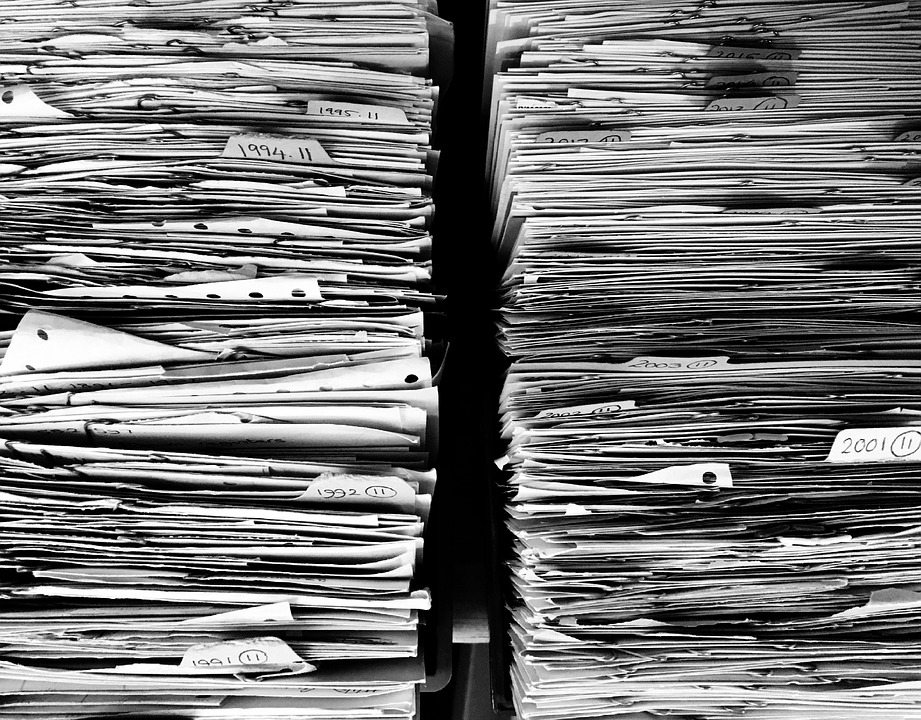

There’s a well-worn cliché that says, “If it’s not in writing, it didn’t happen”. When it comes to your nonprofit, no truer statement was ever uttered! But, unless you are the uber-organized type who just instinctively writes everything down, documentation may not be your strong suit. So what exactly do you need to be keeping records of? In this article, I want to talk about four critical categories of recordkeeping and how you can make sure you have your bases covered.

Perfecting the habit of properly documenting the activities of your nonprofit is one of the most important disciplines any nonprofit leader must master. It’s not only best practice…it’s also an absolute necessity. You simply cannot fulfill even the most basic of legal and fiduciary duties if thorough recordkeeping isn’t an ingrained part of your standard operating procedures. There are many avenues of recordkeeping we could explore, but here are 4 big areas of concern.

The first category is your accounting records. If anything needs to be buttoned up tightly, this is it! Both state and federal regulations require that the financial records of your nonprofit be complete, accurate, and consistent with Generally Accepted Accounting Principles, or GAAP. In fact, your board has a fiduciary responsibility to ensure your accounting records are accurate.

Unfortunately, this is an area we frequently see relegated to “we’ll get around to it” status, especially with smaller nonprofits. It’s not that the leaders don’t care. It’s usually more a situation where no one in leadership is an accounting professional, but they feel that they cannot afford to hire outside help. So it gets put off until the finances are a mess and it is virtually impossible to prepare and file an accurate IRS Form 990 or state fundraising registration report.

Do NOT let this happen to your nonprofit! It’s irresponsible and it’s a violation of your legal obligation as an officer or director of the board. You simply must have accurate accounting records, so plan for it from day one. And even if you are fortunate enough to have a someone inside the organization who is well-versed in nonprofit accounting, we still highly recommend you enlist the services of a competent, third-party professional (like Foundation Group) to manage your accounting AND to prepare your annual IRS Form 990 and related filings.

The second category is donations. There are two reasons why this is so important: First, you have a regulatory requirement to keep accurate records of who gave what and when. This is true of both cash and non-cash (or in-kind) gifts.

First, the IRS will want details concerning this information on your Form 990, specifically for larger donors. Nonprofits that are required to file Form 990 or 990-EZ are required to list on Schedule B all donors who gave $5,000 or more, assuming those donors are individuals, companies, or non-public charity nonprofits. For some nonprofits, the threshold for listing larger donors is 2% or greater of donated revenue.

Also, the IRS requires nonprofits to carefully track donor data so that the public support test can be accurately calculated.

There’s also a very practical reason to track donations. Accurate records of donor activity makes is much easier to solicit future contributions from your supporters. And, as we have discussed in other articles, building a fan-base of consistent givers is fundamental to your nonprofit’s financial health.

It may seem kind of obvious, but you need to keep copies of all your corporate documents, such as your Articles of Incorporation, bylaws and related amendments, and your corporate annual reports. What might be less obvious is board meeting minutes, which are the notes of what was discussed and decided in any board meeting.

This is an often overlooked piece of recordkeeping that is critically important. If the IRS or another government agency examines your nonprofit for some reason, it is very common for them to request documentation of board decisions. You do not want to find yourself in a situation of defending a board action, such as compensation for your Executive Director (who also happens to be a board member), and not have evidence of arms-length decision-making.

And, it’s not just the IRS who might have interest in your minutes. If your nonprofit is ever involved in a legal dispute of any kind, board meeting minutes are one of the first things to be subpoenaed. Oh, and make sure your minutes reflect what actually transpired in your board meetings, not a revisionist history. Resist the urge to document every point and counterpoint of discussion. What’s most important is capturing the overall nature of an agenda item, and the resulting decision, including details of votes.

The final category we will examine is activity records. What has your nonprofit been up to? This category may include things ranging from fundraisers or specific program activities. If it is a fundraiser, what happened? How much money came in? What was the cost of conducting it? Same thing for programs. What was accomplished? How many people were served?

This is all information that the IRS and your state will likely want details concerning. Again with regard to the IRS, program accomplishment data and fundraiser details are required disclosures on Form 990 for nonprofits filing anything greater than a Form 990-N. Your state fundraising registration renewal may seek some of these details as well, particularly details on fundraising events.

Program data and fundraiser success stories also makes great content for communicating to your donor base all the incredible things your nonprofit is accomplishing. Nothing breeds success quite like success! If you’ve got great things to say, say it. Donors like to support what is going well to help you keep in moving in the right direction.

As you can easily see, recordkeeping cannot be an afterthought for your nonprofit. Knowing what needs to be documented, then actually doing the work of putting into your permanent records, is essential to making sure your nonprofit stays in compliance and, by extension, improves donor and stakeholder engagement. Yes, it’s your duty. But it’s also one of the key ingredients of long-term success.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (5)

Comments are closed.

Thank you for this!

My next question is around best practices for HOW to keep records. I have seen more small and emerging nonprofits, including my first one years ago, struggle with how and where to keep records. What should be physical copies and what should/can be digital? Where should records be kept? So many small orgs are run out of someone’s dining room or garage-something happens to them and poof, all is gone.

Any guidance in where to find more on this would be super appreciated-thanks!

Great question, with a multitude of possible answers. I’m a fully digital kind of guy, so that’s where I lean first. A very well organized cloud filing system works well. Think Google Drive or MS OneDrive. I would make sure to set up an account exclusively for the organization, not use someone’s personal account. There may be some reason you need to keep a document that is wet-ink signed, but this is becoming less and less so. As a company, we are a 45 employee business with thousands of clients around the world, and we almost NEVER deal with paper. Everything gets digitized. Hope that helps!

Very good and helpful information in this video!

Very informative! Pls comment on the idea of using a series of shared folders (ie on G drive) as a way to save corporate records — particularly minutes and financials.

That’s certainly one way to do it. Can’t see why it wouldn’t work, as long as it’s well organized.