Church Incorporation: How to Build A Compliant Congregation

What are your goals as a church leader? Are you passionate about ministering to others? Perhaps you want to offer hope to an entire community.

Like any organization, churches need a clear vision of their purpose and the tools to maintain legal compliance in order to achieve their goals. That’s why church incorporation is an important step in starting your church and furthering its mission. In this guide, we’ll cover everything you need to know about church incorporation, including:

- What Is Church Incorporation?

- Why Is Church Incorporation Beneficial?

- What Is Needed To Incorporate A Church?

- How To Incorporate A Church

Incorporation is important for every church, but it may look different depending on your church’s size, home state, and other circumstances. We’ll answer your questions in the guide below, but you can also talk to a professional for one-on-one advice about your church’s unique needs.

What Is Church Incorporation?

Incorporation is the process of creating a new legal entity. An incorporated organization is considered a legal “person,” meaning it holds the same rights and responsibilities as an individual. This status allows the organization to act as a formally organized entity and accept liability for its actions.

Church incorporation is the establishment of a church as its own, legal entity, separate from its founders or leaders. While incorporation isn’t necessary to start a church, there are many advantages to church incorporation.

Why Is Church Incorporation Beneficial?

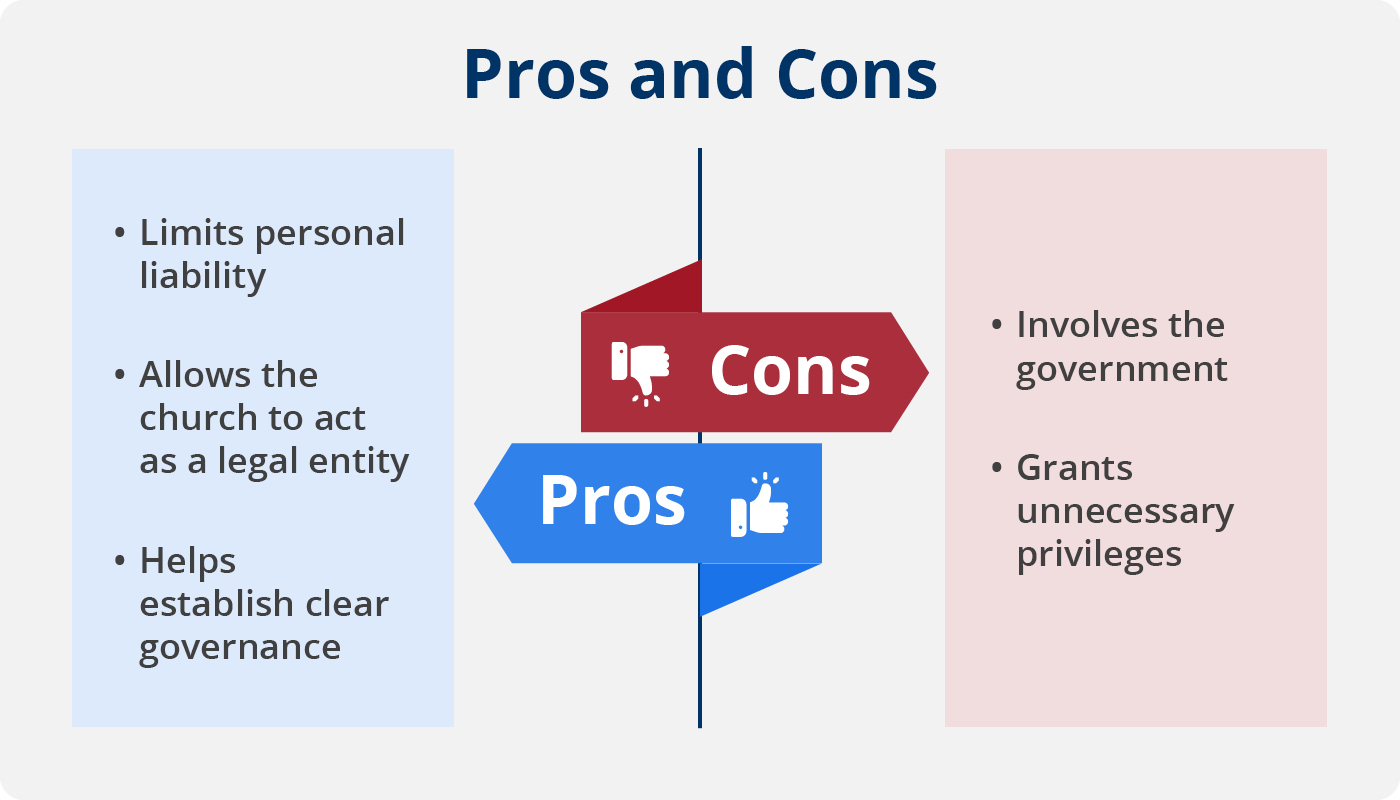

If you’re unsure of whether or not to incorporate your church, consider the pros and cons of incorporation:

In terms of advantages, church incorporation:

- Limits personal liability. The most obvious advantage of church incorporation is that it protects individual members, including the church’s founders, leaders, and congregation members, from most personal liability, excluding gross negligence. For example, a car accident involving your church’s van would usually become the liability of the church rather than the church’s leaders or the driver, unless, of course, gross personal negligence was involved.

- Allows the church to act as a legal entity. An incorporated church can fully act as a legal entity. This means it can borrow, own, or transfer property in the name of the church. Your church can also enter contracts when legally incorporated without requiring personal guarantees of the church’s leadership.

- Helps establish clear governance. When it comes to obtaining a loan or signing legal documents, an incorporated church has the freedom to operate through its board.

Some churches view the following as cons of incorporation:

- Involves the government. Some churches choose not to incorporate in an effort to stay separate from the state or federal government. However, the truth is that your church’s supreme authority comes from its Articles of Incorporation. By including the proper clauses in this document, your church retains control of its actions. Remember, the “church” here is the organization, but the true church is the body of Christ.

- Grants unnecessary privileges. Because a church can lawfully exist without incorporation, some find the process and subsequent privileges unnecessary. It’s up to you to determine what’s best for your congregation, but in most cases, incorporation is an important part of achieving your church’s goals. Incorporation provides privileges that protect the leaders who work to further the church’s mission and grant the freedom to take legal action as needed. For example, an incorporated church could buy land to expand its ministry across a community.

Most compliance experts will agree that church incorporation has far more pros than cons. If you’re convinced of the need for incorporation, let’s explore what you’ll need to get started.

What Is Needed To Incorporate A Church?

Church incorporation is enacted at the state level, meaning most churches must go through the Secretary of State’s office. However, the process includes more than just one simple filing—you’ll need additional documents that protect your church and establish its governance. Plus, you may have to continue filing a report every year to maintain corporate status.

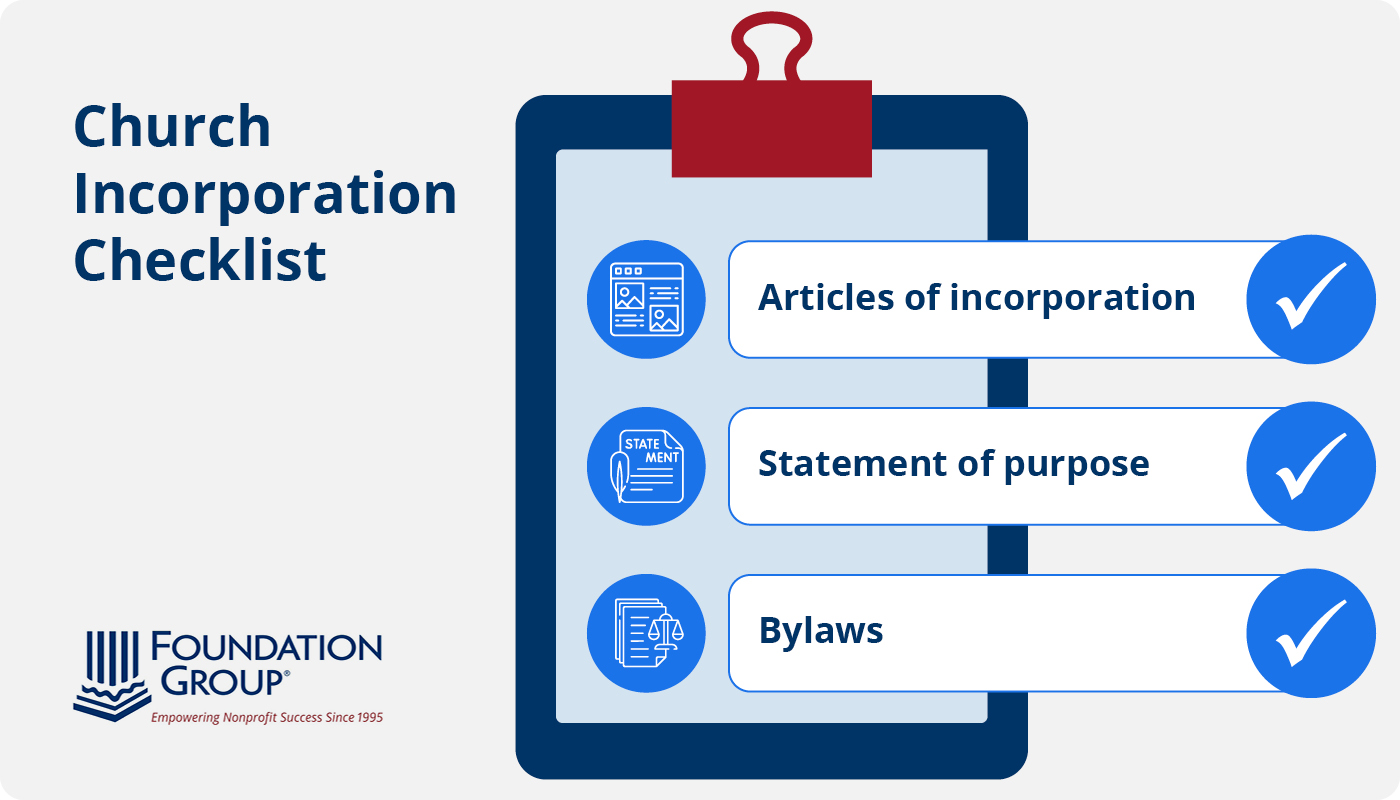

To get started with church incorporation, you’ll need to prepare:

- Articles of Incorporation: Your church’s Articles of Incorporation serve as its supreme legal document, recording your church’s formal creation of a corporation. You’ll likely submit Articles of Incorporation to your state’s Corporations Division, along with a small filing fee. Once filed, your church will be officially incorporated.

- Statement of purpose: This document clearly lays out your church’s intended purpose, which should be strictly religious in nature. Not only is your statement of purpose helpful for securing 501(c)(3) status, but you can also share it on your church’s website to draw attention to your church’s mission.

- Bylaws: These governing policies are strictly for internal use and shouldn’t be filed with your Articles of Incorporation. However, bylaws are necessary for church incorporation because they detail the internal governance of your organization. They serve as the source of truth for determining whether or not your church’s leaders are acting within their scope of responsibilities, which can ultimately protect your church against lawsuits or other legal issues.

Don’t stop after incorporation. To maintain your status and ensure your church is set up to operate smoothly and properly, you’ll need to review these documents at least once a year. Your bylaws, for example, may need revisions to reflect and better serve your church’s mission.

Additionally, incorporation is a necessary stepping stone to other provisions for your church, like 501(c)(3) status. If you want official determination of 501(c)(3) status from the IRS, you’ll need to ensure you incorporate properly and maintain corporate status.

How to Incorporate a Church

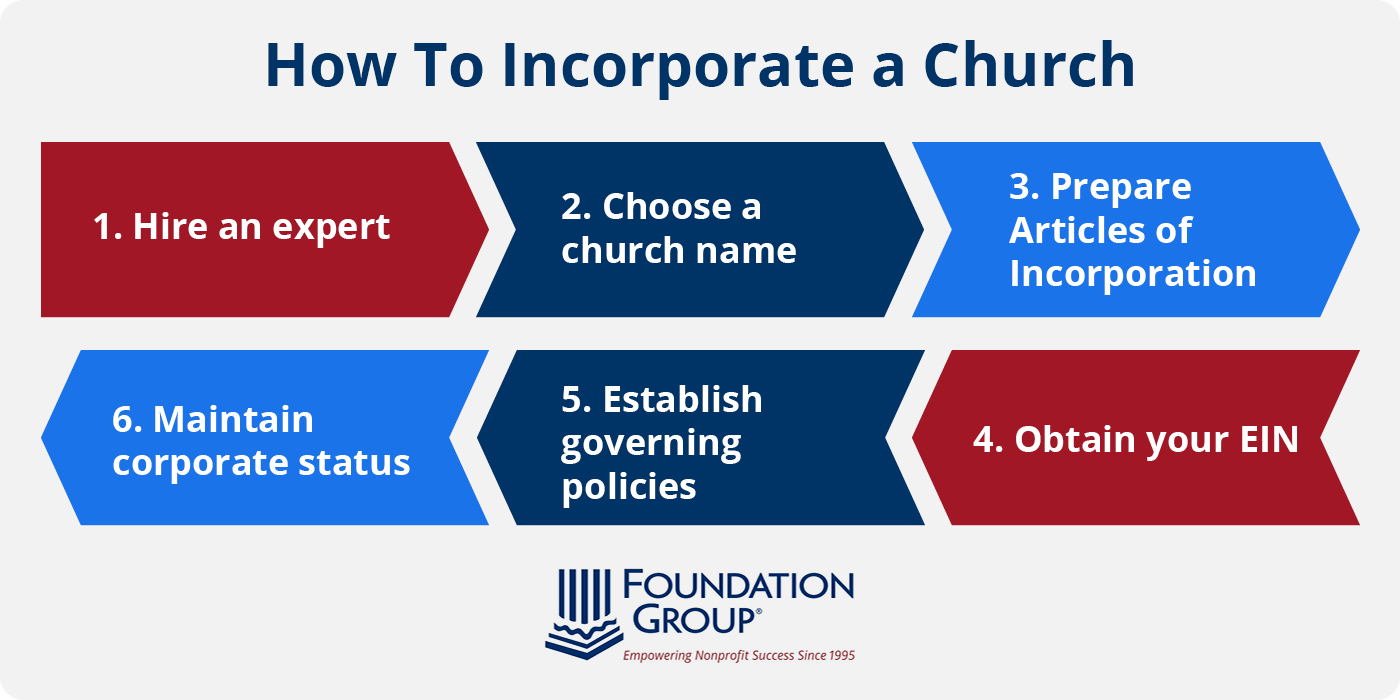

As you can see, church incorporation involves determining the purpose of your church and how it will operate. Failing to establish the proper provisions can negatively affect the future of your church, so you’ll want to approach it carefully. Consider the following six steps to church incorporation.

1. Hire an expert

As part of the 501(c)(3) application process, incorporation can be handled with ease by compliance experts. This means that you won’t just receive professional guidance for incorporation, but also for obtaining official 501(c)(3) determination when you reach out to an expert for help.

Trusting a professional can help you:

- File everything correctly. While Articles of Incorporation and tax filings might seem confusing, they’re part of compliance experts’ day-to-day jobs. A professional will know how to file everything correctly and in a timely manner, getting your church incorporation process started on the right foot.

- Establish necessary provisions. If you’ve never incorporated a church before, it will be difficult to know how to set yourself up for success. For example, what provisions should you establish in your bylaws to protect your church in the future? An expert will think of the things you didn’t know needed to be included and give you tips for success.

- Save time and effort. Your church’s legal compliance is likely not your top priority, especially when trying to minister to people through a new startup. Outsourcing church incorporation to an expert can save you time and energy for what’s most important to you: your mission.

At Foundation Group, we’ve helped over 25,000 startups, and incorporation is a core step every time. That’s because incorporation is a key component of our SureStart services. With Foundation Group’s SureStart services, you can focus on your ministry while the experts handle everything else, including checking name availability, obtaining your Employer Identification Number (EIN), writing your bylaws, and preparing your Articles of Incorporation.

2. Choose a church name

If you’re getting started without the help of an expert, your first step in church incorporation will be to choose a church name. The name of your church must meet state requirements and can’t match the name of another incorporated organization.

3. Prepare Articles of Incorporation

As we discussed earlier, your church’s Articles of Incorporation officially deem your church incorporated. To prepare this document, you’ll typically need to provide:

- Your church’s name

- Your church’s purpose

- The name of your registered agent

- The address of your principal office

- A statement of indemnification

- A list of prohibited activities

- A dissolution clause in case your church dissolves

- The name and address of the church’s incorporator

Because each state determines its requirements for Articles of Incorporation, this list may vary depending on the state your church is in. A professional will likely have experience incorporating in several states and can ensure you include everything required by your state.

4. Obtain your EIN

Your federal EIN is a unique, 9-digit number assigned by the IRS to identify your organization for tax purposes. Once you complete and submit the online application, you’ll receive your EIN. Be sure to download your EIN confirmation notice for your records.

5. Establish governing policies

You’ll establish your church’s purpose when filing the Articles of Incorporation, but you’ll also need a clear plan for how you’ll fulfill that purpose. That’s where bylaws come in.

These governing policies clearly outline how your church will operate and should be consistent with your Articles of Incorporation. Be sure to craft bylaws that are specific to your church and its beliefs, seeking input from your congregation if necessary. Your bylaws should thoroughly address the ground rules for decision-making concerning the church, clearly laying out positions of authority and determining how members will be held accountable.

6. Maintain corporate status

After incorporating your church, you’ll need to maintain corporate status over time. File an annual report, or a Statement of Information, with your Secretary of State’s office each year. This document will include vital information about your church, including its activities throughout the year.

Since you’ll need to submit a comprehensive report of your church’s activities, you must practice effective recordkeeping throughout the year. This way, you’ll be prepared to submit an accurate report and avoid scrambling to find information for the filing. Your church may hire an expert for its recordkeeping needs, too.

Church Incorporation Resources

Church incorporation is vital to protecting your church’s members and establishing a clear plan for your ministry. But if incorporation isn’t your forte, that’s okay! Outsourcing your church’s startup to a professional can ensure you navigate the process accurately and with ease.

If you’re interested in learning more about operating a church, check out the following resources:

- Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. Incorporation is just the first step. Learn about other necessary applications for your church in this guide.

- The Best Guide to Bookkeeping for Nonprofits: How to Succeed. Need help with your church’s financial records? Learn about effective bookkeeping here!

- How to Start a 501(c)(3) Nonprofit. Looking to start an organization with a charitable purpose? Read our guide to starting a 501(c)(3) nonprofit for more information.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (0)