Does a Church Need 501(c)(3) Status? A Guide to IRS Rules

If you’re well-versed in the basics of 501(c)(3) organizations, you know that 501(c)(3) status requires an organization to have an IRS-determined charitable purpose. One category of qualifying charitable purposes that these organizations can hold is religious. But there is a difference between religious organizations and churches, and it’s important to understand this difference before determining whether or not your church needs a 501(c)(3) status.

What does it mean for a church to be a 501(c)(3), and does a church even need that status? Let’s take a closer look at the IRS’s rules for this determination.

Overview of a Church’s Status

The practice of charity and “doing unto others” is an ancient concept. The Christian church has existed for approximately 2,000 years, and other religions have church histories going back much further than that.

But what we know today as the “nonprofit sector,” which represents a sizable part of the US economic and service systems, only came to be in the early 1970s. So, given the relative age difference between churches and the idea of a modern nonprofit, what does that mean for churches? Are they nonprofits? Should they be 501(c)(3)?

Let’s take a look at their connections to determine the answer.

Church Nonprofit Status

Legally, a nonprofit is an entity that is organized for a non-commercial purpose. It exists separately from the individuals who operate it, to a lesser or greater degree depending upon the entity structure chosen. For example, a nonprofit that operates as an unincorporated association has little legal separation between the parties, while a nonprofit corporation provides a significant separation between people and the entity.

No matter the legal structure, the key element is the non-commercial nature of its activities. The purpose of starting a nonprofit is not to conduct commerce for monetary profit. Operated properly, a nonprofit’s programs and activities accomplish purposes and goals that are strictly non-commercial.

A typical American church is a great example of an organization with activities that are non-commercial in nature. Even in the occasional example where a church may have some commerce, like a bookstore, the exercise and promotion of religion is the primary activity. By definition, that is a non-commercial, hence nonprofit, nature of operations.

So, yes—a church is a nonprofit.

Church 501(c)(3) Status

Now that we’ve established that a church is a nonprofit, we must answer the question of whether or not a church is a 501(c)(3) organization. This answer is a little complicated.

Section 501(c)(3) of the US tax code describes nonprofits that are charitable in nature. Organizations determined to be 501(c)(3) by the IRS are recognized as such because their purpose satisfies the limited scope allowable. Those purposes are:

- Religious

- Educational

- Scientific

- Literary

- Testing for public safety

- Amateur sports promotion

- Preventing cruelty to animals and children

The list also covers those purposes that are more generally charitable. Churches exist to exercise and promote religion, so they are inherently religious organizations. That’s how they qualify to be 501(c)(3)s.

For the vast majority of charities, the IRS will only recognize a nonprofit as a 501(c)(3) when it applies for such recognition by filing Form 1023, and it is then subsequently granted in the form of a determination letter. For churches, it works differently.

By default, the US government considers churches to be 501(c)(3) organizations automatically, simply by virtue of existing. Because no corporate structure is needed, a church (generally) is a 501(c)(3).

Churches vs. Religious Organizations

As you can see, churches are nonprofit organizations. However, religious nonprofits are not always churches.

Religious nonprofits such as nondenominational ministries and organizations that study religion can have religious purposes as determined by the IRS without being a place of worship. However, these organizations must apply for 501(c)(3) status to be tax-exempt.

Does a Church Need To Apply for 501(c)(3) Status?

If a church is automatically considered a 501(c)(3) tax-exempt charity, why bother filing Form 1023 and applying for an IRS determination letter? Watch this short video to explore the answer:

As our video explains, the lack of a determination letter doesn’t imply a “lesser” 501(c)(3) status. A church operating without official IRS recognition is still tax-exempt, and it is still able to provide its donors with a potential tax deduction for gifts given. It has all the rights, privileges, and accountabilities of any other charity with a 501(c)(3) determination letter.

However, churches can choose to officially apply for 501(c)(3) status, and there are some advantages and disadvantages to doing so.

Pros and Cons of Applying for Church 501(c)(3) Status

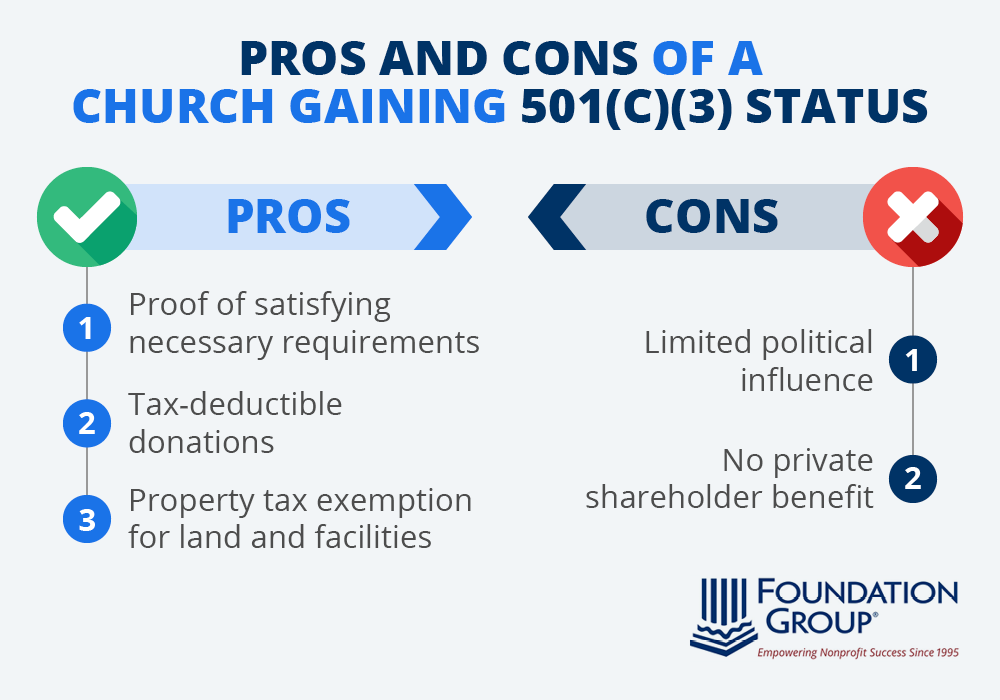

While there are some disadvantages to obtaining 501(c)(3) status, all US churches should seek and obtain an IRS determination letter. Let’s weigh the pros and cons.

Churches should obtain 501(c)(3) status for the following benefits:

- Proof of satisfying necessary requirements: While rights and privileges are the same, there is a distinct difference between assumed status and official recognition. Churches operating under an assumed status have the burden of proof that they are indeed satisfying the necessary requirements, while those with a determination letter have no such burden.

- Tax-deductible donations: Taxpayers under audit who have their donations to your church challenged are at a distinct disadvantage if you do not have a determination letter. The tax deduction may be disallowed if the donor can’t prove the church is a qualifying charity. Remember, if you are operating under an assumed status, the IRS isn’t even aware of your church.

- Property tax exemption for land and facilities: Your church may find it difficult to obtain property tax exemption for its land and facilities without a determination letter.

It’s also important to note that most donors expect your church to have a determination letter. After all, official 501(c)(3) status signals that your church has been deemed charitable by the IRS, increasing your trustworthiness in the eyes of those who support it.

However, 501(c)(3) organizations do have some limits on activity, especially where it involves campaigns for public office, as well as commercial activities. This could be a potential downside to gaining official 501(c)(3) status, as your church will have:

- Limited political influence: 501(c)(3) organizations cannot support political candidates or campaigns.

- No private shareholder benefit: A 501(c)(3) status requires that your organization’s activities and earnings do not benefit private individuals in any way.

A tiny handful of churches have given up 501(c)(3) status in order to do and say whatever they choose without regard to limits otherwise placed on charities. However, this comes at the cost of tax exemption and privileges, as well as the ability to have donors give tax-deductible gifts.

If for some reason you and your church leadership decide that you don’t want to be a 501(c)(3), you are simply deciding to be treated like a taxable, for-profit business.

Final Thoughts On 501(c)(3) Status for Churches

A US-based church is, by definition, both a nonprofit organization and a 501(c)(3) tax-exempt entity. The best practice is to solidify that standing by incorporating at the state level and seeking official IRS determination. There’s a lot of misinformation out there, so lead well and stay informed—your congregation will thank you for it!

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Are there additional reporting requirements if a church becomes a registered 501c3?

Dear Kurt, One of the benefits of getting status as a “church” from the IRS is that they are exempt from Form 990 filings that other exempt organizations have to file annually. Additionally, many states will exempt churches from Charitable Solicitation Registrations.

Churches still have to report and pay taxes on any commercial endeavors, but otherwise, generally, there are fewer filing requirements.

The transparency and accountability demonstrated by your church in financial matters is commendable. Your organization’s commitment to responsible stewardship of resources and open communication with its members instills trust and confidence in your congregation.

Thank you, Thomas. We believe in best practice as that is the way to have a successful non-profit.

This is not really a Church. But rather questions about a 501 (c) (3) and 501 (c) (6).

Question 1. An existing 501 (c) (6) a Nurses Association is wanting to establish a 501 (c) (3) having the same Board of Directors. Is this a possible?

Question 2. If not possible. Can the existing Nurses Association 501 (c) (6) can be changed or converted to 501 (c) (3)?

Question 1: Yes, it is entirely OK to do that.

Question 2: Probably not, unless the Association is exclusively charitable or educational, which is not likely.