How to Start A Ministry: Everything You Need to Know

Whether you’re already a church leader, or you’re starting an initiative from scratch, you know that the calling to start a ministry can’t be ignored. However, you may not know how to start a ministry, especially since the process can be so complex.

In this guide, we’ll cover the essential topics for learning how to start a ministry, including:

If you’re ready to start a ministry, this guide is a great starting point. However, you can also reach out to a professional for one-on-one guidance throughout the process. With those options in mind, consider how you’ll start a ministry as you learn the basics.

What Is a Ministry?

In Christianity, a ministry is an initiative launched to express or share faith with others. This could be a program started by an existing church or a project spearheaded by an individual, and the possibilities are as vast as the various missions people feel called to. In other religions, ministries serve a similar function, that is, they are parachurch organizations that supplement the work of local churches.

For example, your ministry might consist of a group of believers who travel to different college campuses and spread the gospel. Or, it may be a small prayer group that meets at someone’s house to pray over the neighborhood monthly. The possibilities are endless. The specific nature of a ministry depends on the calling that started it.

Legally speaking, a ministry is a religious charity. This means a ministry is viewed as a charity with a religious purpose by the IRS, and must go through the same startup process as any other nonprofit.

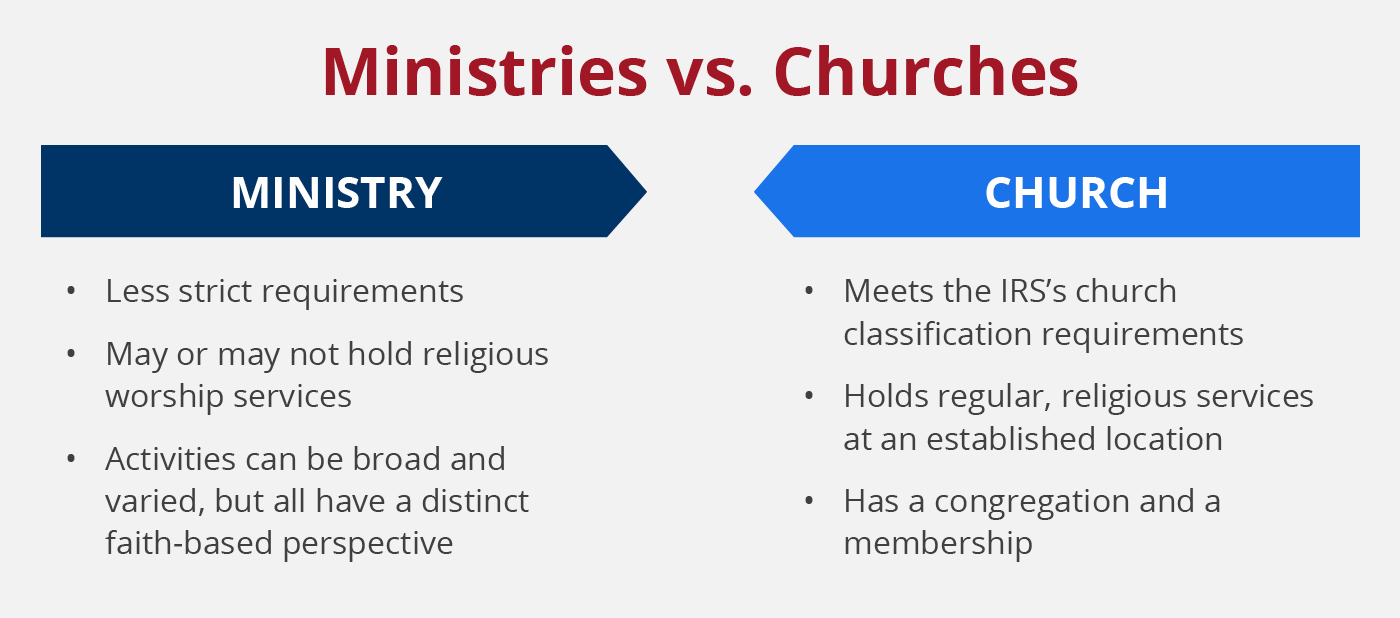

Ministry vs. Church

There are two primary ways that you can share your faith and minister to others: religious ministries and churches. Before learning how to start a ministry, you should first understand what a ministry is and determine whether or not it’s the best way to answer that calling.

Here are the distinct attributes that differentiate a ministry from a church:

A ministry has:

- Less strict requirements: While ministries are still tax-exempt, they are much more flexible than churches. Ministries are governed by religious principles rather than strict organizational authority, and they have a broader range of qualifying activities.

- May or may not hold religious worship services: Whereas churches hold regular, religious services at an established location, ministries may or may not do the same. In fact, most religious charities don’t conduct worship services at all.

- Activities can be broad and varied, but all have a distinct faith-based perspective: From enormous entities to small religious charities, ministries can all look and operate differently. However, they must have a faith-based perspective to qualify as a ministry.

A church, in contrast:

- Meets the IRS’s church classification requirements.

- Holds regular religious services at an established location.

- Has a congregation and a membership.

Keep in mind that starting a church or a ministry could be the answer to a calling to share your faith. It’s best to understand the difference between the two so you can decide which would best fulfill your mission.

Examples of Ministries

While ministries take countless forms, there are a few common types that most ministries follow:

- Student ministries: Many ministries aim to serve the student population in high schools or on college campuses. These groups can even be student-led—all they need is permission from the school to get started.

- Evangelistic ministries: Some ministries reach the local community via traveling speakers or evangelistic pamphlets. These programs don’t have to be tied to a church but sometimes focus on inviting unchurched members of the community to attend a specific church.

- Missionary work: Missionaries typically venture far outside of their local communities to serve others in tangible ways. For example, missionaries might complete a project, like building a school or bringing food to the hungry. Then, they use these acts of service to share their faith with others.

Remember, every ministry looks different depending on its purpose, community, and unique circumstances. You can start a ministry to serve young students, unchurched members of the community, people in faraway places, or any other group you feel called to serve.

Can You Start a Ministry Without a Church?

A ministry is an independent organization and can be founded completely separately from a church. However, to establish a formal ministry, there are some legal requirements you’ll need to follow.

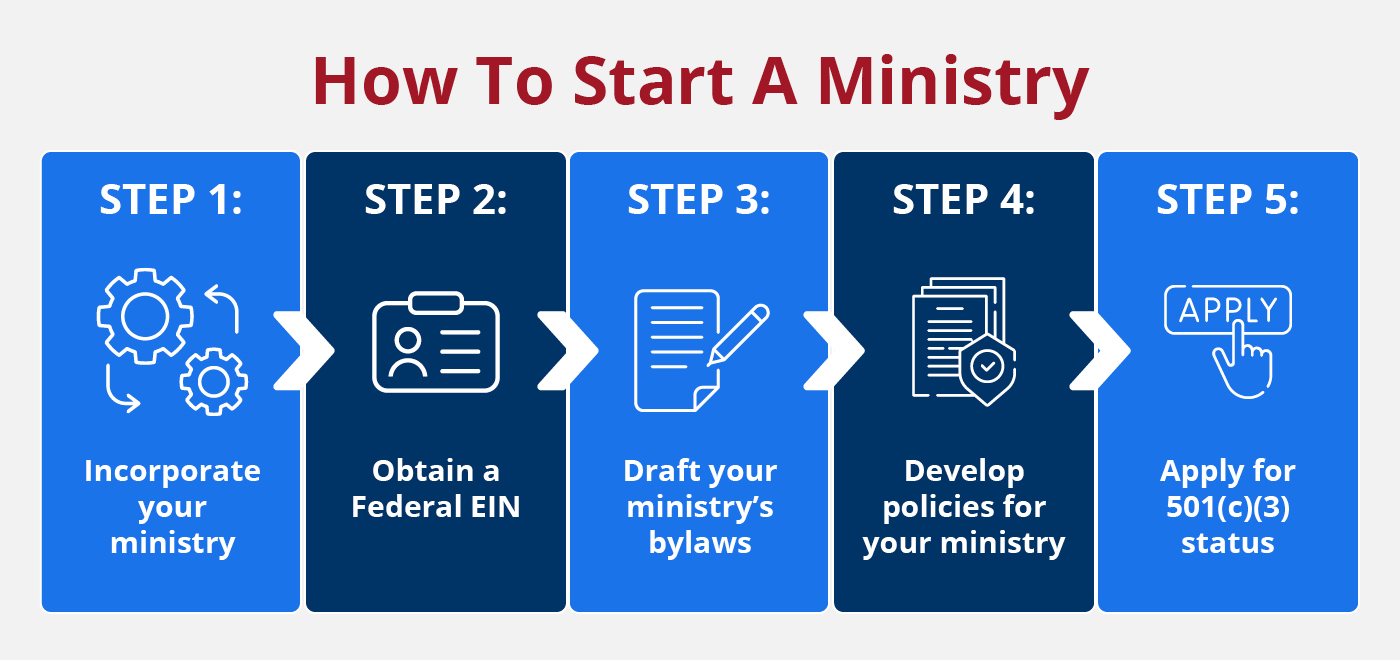

How to Start a Ministry In 5 Steps

Once you’ve determined that a ministry is the best way to fulfill your purpose, the real work begins. There’s a lot that you’ll need to do to start a ministry, and we’ve broken it down into the following five steps.

1. Incorporate your ministry.

Incorporation is the process of establishing an organization as its own legal entity separate from its founders or active members. For this reason, structuring your ministry as an incorporation protects its leaders from liability should any legal issues arise.

Because incorporation is enacted at the state level, you’ll need to file Articles of Incorporation with the state in which your ministry is founded to incorporate. This process involves the following steps:

- Completing the Articles of Incorporation.

- Attaching any additional required documents.

- Paying a state incorporation fee.

This process is a crucial first step in how to start a ministry because it offers legal security. Plus, it helps to solidify your purpose and vision since you’ll have to determine the basics about the ministry from the very beginning.

2. Obtain a federal EIN.

After your Articles of Incorporation have been accepted and approved, you’ll need to apply for a federal Employer Identification Number (EIN) with the IRS. An EIN is like your ministry’s social security number—it is a unique number assigned to your ministry to help the IRS identify you.

This unique number allows your ministry to open a post office box and complete tax filings. To obtain an EIN, file Form SS-4 online, by mail, or by fax.

3. Draft your ministry’s bylaws.

When learning how to start a ministry, you must be prepared to explain why and how your ministry will operate. This is where your ministry’s bylaws come into play.

Bylaws are one of the most important documents for your ministry because they establish your ministry’s purpose and governing structure. This ensures that your ministry will always operate in the best interest of its mission. Plus, you’ll need bylaws to apply for 501(c)(3) status, so it’s important that you draft them at this stage.

4. Develop policies for your ministry.

While bylaws cover your ministry’s governing structure, you should also develop policies for the more specific tasks that your ministry will carry out. For example, what expectations do you have for ministry workers?

The correct wording is crucial for establishing legally sound policies. Be sure to have an attorney or compliance specialist help craft them to ensure you cover everything.

5. Apply for 501(c)(3) status.

There are numerous benefits to officially applying for 501(c)(3) status, and your ministry must apply to access them. Aside from the tax-deductibility of donations, your ministry may also be exempt from property taxes and sales taxes, depending on the state it’s in.

Your ministry may already have 501(c)(3) status if it’s part of an existing ministry with the official determination. If your new ministry is part of an existing church, look into the church’s 501(c)(3) status, and determine whether or not you’ll need to apply.

If your ministry isn’t associated with a church, you should apply for official 501(c)(3) status with the IRS. This process involves:

- Filing IRS Form 1023

- Submitting your certificate of formation, bylaws, and EIN

- Paying all applicable fees

If your ministry is granted 501(c)(3) determination, your ministry-related income will be exempt from federal taxes. Plus, any donations made to your ministry will be considered tax-exempt.

Unlike churches, however, your ministry will NOT be exempt from some tasks, like filing Form 990 annually. This annual filing is critical to prepare and file on time, as failure to file for 3 consecutive years will result in the IRS automatically revoking your ministry’s 501(c)(3) status.

Best Practices To Start a Ministry

You can use this guide as a checklist for learning how to start a ministry, but there are some additional best practices you should consider to ensure you do it right the first time around. Ask yourself the following questions to successfully start a ministry:

- Does it address a need? The best way to start a strong and impactful ministry is to ensure it meets a real need. Does the ministry address the needs of a majority? Can your ministry offer a solution to the problem? Is the need being met by another ministry or organization?

- Does it align with your church’s strategy? If your ministry is part of an existing church, ensure it aligns with your church’s strategy. Since the two organizations must work together to spread similar messages, taking the time to reflect on your church’s strategy will ensure your new ministry is successful.

- Did you recruit a leader? Just because you’re the one starting a ministry doesn’t mean you’ll be the one to sustain it. With effective delegation, the right leaders can spearhead your ministry’s mission. Ordain ministers to lead your ministry and fulfill its purpose.

- Do you have an action plan? Build a specific plan of action for your ministry to determine exactly what you aim to accomplish and how you’ll achieve it. Start with your broader goals, like the vision of your ministry, and narrow down your plan to address the specific actions you’ll take to fulfill your mission and continue it in the long term.

- Do you have a plan for evaluation and improvement? Any ministry that simply sets a goal and accomplishes it will be short-lived. Determine how your ministry can best serve its community and spread its message by planning for frequent evaluation and improvement.

Remember, learning how to start a ministry is just the framework for actually putting your mission into action. You’ll need expert tips and best practices to tweak your approach and ensure the longevity of your initiative.

Possibly the best practice you can employ for a successful ministry is to enlist the help of compliance experts to get started and maintain your ministry over time. Consulting a professional gives you access to knowledgeable advice and the convenience of having someone else manage startup and compliance tasks for you.

Additional Resources for Your Ministry

If you’re wondering how to start a ministry, you’ve likely experienced an unignorable calling to spread your faith. This is a huge undertaking—and it should get your full attention. Trusting a professional with your ministry’s startup and compliance needs allows you to focus on what’s most important to you: your mission.

If you’re ready to work with an expert, reach out to Foundation Group to learn about our SureStart services. If you’re looking for more insight into starting a mission-centric or faith-based organization, check out the following resources:

- What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status. Before you turn your ministry into an official 501(c)(3) organization, you might be wondering what 501(c)(3) actually means. Learn the basics in this guide.

- Church Bookkeeping Services For Your Faith-Based Ministry. Every ministry needs funding, and with funding comes a responsibility to keep accurate records and clean financial data. Learn how Foundation Group can help here.

- Charitable Solicitations Registration Overview and Services. What rules surround your ministry’s ability to raise funds for its cause? Check out this guide to learn about charitable solicitations and how your ministry can get help managing potential registration requirements.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!