Can Nonprofits Sell Products? Unrelated Business Income 101

Whether you’ve just started your nonprofit or have been serving your community for decades, selling products can help your organization raise additional funds to support its mission. The products give donors a tangible reward and memento of their contribution, fostering brand awareness and deeper, long-term support.

However, there are certain rules organizations must follow to comply with IRS regulations around unrelated business activities. In this guide, we’ll explore the basics of selling products and compliance:

- Can Nonprofits Sell Products?

- What Is Unrelated Business Income?

- Acceptable Ways to Generate Revenue via Product Sales

- 5 Tips for Selling Products & Services as a Nonprofit

To get started, we’ll answer some common questions about the legality and tax implications of conducting unrelated business or retail activities.

Yes, nonprofits can sell products to generate revenue for their mission as long as they meet certain criteria. To remain fully tax-exempt, these products or services must directly promote your cause or meet other standards. Otherwise, the revenue generated through your product sales might be subject to Unrelated Business Income Tax (UBIT).

Unrelated business income (UBI) is income generated by a sale or other business regularly practiced by an exempt organization and is not substantially related to the organization’s exempt purpose or function, except that the organization uses the profits derived from the activity.

In other words, UBI is revenue generated from selling products or services that are not closely tied to your mission (e.g., operating gift shops or reselling retail items without a volunteer workforce). However, certain trade or business activities are not treated as an unrelated trade or business. We’ll cover these exceptions in the next section.

Selling a product is typically seen as a commercial or for-profit business venture. Though revenues received from selling products may support charitable initiatives, this does not inherently make the act of selling a product a charitable activity.

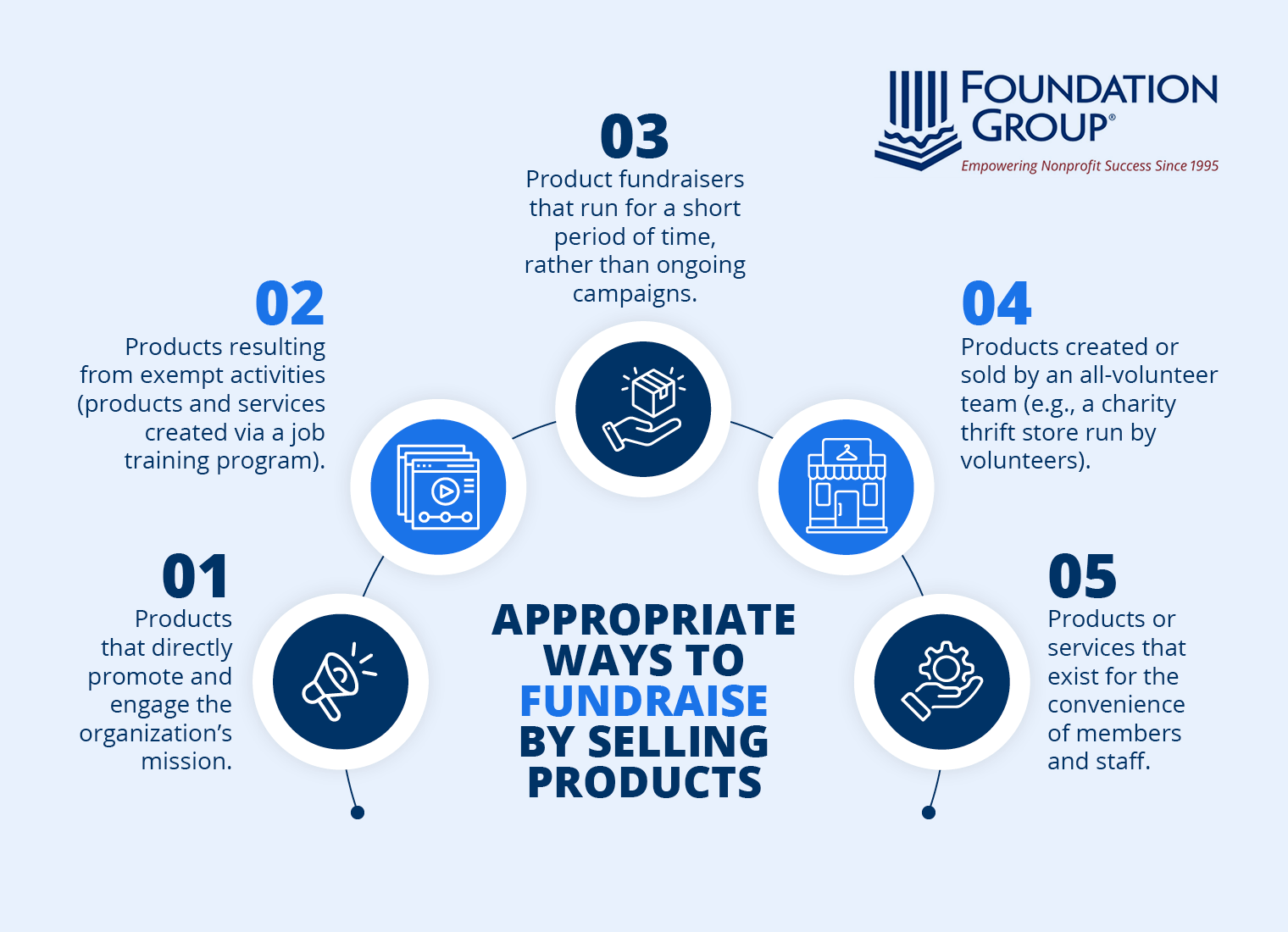

If done correctly, there are several methods by which a tax-exempt organization can sell products on an ongoing basis to generate revenue for program activities. Specifically, 501(c)(3) organizations can sell products that:

For an ongoing product fundraiser, the items must directly promote the organization and educate the purchaser about your mission. Examples include:

- T-shirts with the organization’s name on them.

- An informational card or tag explaining how the purchase supports the exempt program (this is a recent shift from the IRS).

- Bracelets, water bottles, and other similar products that directly promote the organization.

Generally, ensuring products have an educational component related to your mission is a good way to connect them to your cause. If you’re unsure or concerned about revenue from a specific product being subject to UBIT, consider reaching out to an expert who will better understand the nuances of nonprofit tax law.

Though not specific to fundraising, selling products that result from performing an exempt activity is an acceptable sale for a 501(c)(3) organization. This may also include products created through the exempt qualifying program conducted by the organization.

IRS Publication 598 clarifies these guidelines with an example:

If an exempt organization maintains an experimental dairy herd for scientific purposes, the sale of milk and cream produced in the ordinary course of operation of the project is not an unrelated trade or business. But if the organization uses the milk and cream in the further manufacture of food items such as ice cream, pastries, etc., the sale of these products is an unrelated trade or business unless the manufacturing activities themselves contribute importantly to the accomplishment of an exempt activity.

Additionally, products and services created through a job training program are also acceptable to sell.

Items that do not directly promote the organization can only be sold in short-term fundraising campaigns.

For example, consider the annual Girl Scout cookie fundraiser. The cookies themselves do not promote the Girl Scouts, so they can not be sold throughout the year. An ongoing sale would make the cookies a retail activity, which is subject to UBIT. Since the fundraising campaign is limited to a few weeks in the spring, it is acceptable for them to sell the cookies.

Unrelated trade or business activity can be exempt from taxes on income raised if it is the outcome or result of conducting the activity with an all-volunteer workforce. The IRS gives two examples in this regard:

- An orphanage establishes a retail store to raise funds to support the orphanage. Operating a retail store would typically be an unrelated business activity that does not qualify for exemption. However, if the retail store is operated by volunteers, it is exempt from UBI.

- A volunteer fire department hosts weekly dances to raise funds. Again, charging admission for weekly dances would typically be considered an unrelated business activity, but the event is exempt from UBIT if volunteers host it.

Unrelated business activities can also be exempt from UBIT if they are done for the convenience of staff, volunteers, or members.

An example of this is an eating facility at a zoo. Typically, operating a restaurant would be commercial in nature, and its income would be taxable. But in the case of a zoo, the eating facility makes it more convenient for patrons to experience the zoo by allowing them to have a meal while remaining on site. This also allows staff to eat on-site.

The eatery exists for the members’ convenience and supports the exempt qualifying activity, which exempts it from UBIT.

Supporters must be aware that you’re selling products and services in order to purchase them from your nonprofit. Harness the power of digital communication channels to engage donors, such as:

- Social media platforms, like Instagram, Facebook, and TikTok.

- Email, allowing you to send targeted messages to supporters announcing the sale, appealing to donor segments, highlighting deals or deadlines, etc.

- Your website, creating custom landing pages, blog posts, and linking to or embedding your online store.

- Search engines, using search engine optimization (SEO) and search engine marketing (SEM) to make your website more visible to search engine users.

- Digital advertisements that display on search engines, websites, or social media.

Additionally, encourage your supporters to create and share user-generated content (UGC) to help you promote your products and services. For example, have them post pictures of the items on social media and use a custom hashtag in the caption.

Whether you sell apparel, stationery, or home goods, consider adding elements of your nonprofit’s brand to the product design. This can be as simple as using your brand colors or adding your logo.

Customizing the items with your branding allows you to capitalize on existing brand awareness and recognition. This means that supporters will immediately recognize that the products are coming from your nonprofit. Then, each time they use or wear the item, they will think of your organization and spread awareness of your brand to the public.

Branding clearly ties the product you’re selling and your work, as you can use it to educate or promote your mission. For instance, an environmental conservation organization might sell sets of reusable cutlery and straws that supporters can take on the go. While this product is related to their goals around sustainability and reducing pollution, they can strengthen the connection by adding their logo and the slogan, “Refuse Single-Use. Save Our Planet.”

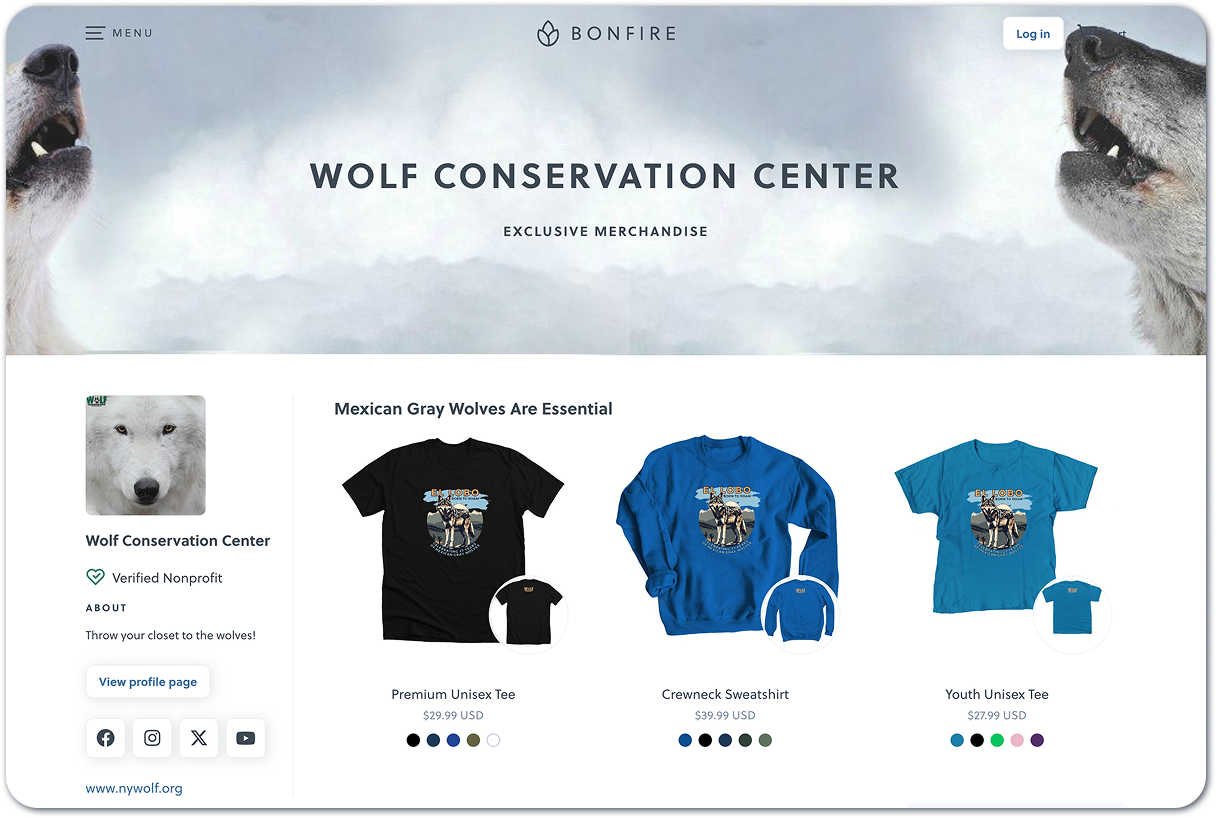

Creating a custom, branded online store for your nonprofit allows you to showcase your mission-aligned products and provide a seamless shopping experience. Not only does an online shop help you reach a larger audience, but it also enhances brand awareness, trust, and community engagement. It’s easy for your marketing team and supporters to share links to the store to drive more sales.

First, your nonprofit will need to select a tool to facilitate your online store. Ideally, this platform should:

- Be easy to set up and use

- Offer nonprofit-friendly pricing or discounts

- Integrate with your current technology, such as your payment processor and constituent relationship management (CRM) system

- Track sales data

- Provide excellent customer support when you’re getting up and running or have questions

From there, you’ll simply need to customize the storefront with your brand colors, logo, and a description of your mission. Then, create listings for each product you’ll offer, detailing the product’s specifications and how it relates to and supports your work.

Align your fundraisers with relevant holidays or awareness months, such as Breast Cancer Awareness Month, to boost sales. This allows your nonprofit to take advantage of the existing buzz around these occasions and provide items that supporters can purchase to commemorate the holiday or give as gifts.

Make sure the product or service resonates with the spirit of whatever holiday you choose. For instance, a Valentine’s Day-themed product fundraiser will likely involve hearts, while a breast cancer awareness campaign would feature the pink cancer awareness ribbon.

Tracking sales data is important for these key reasons:

- Tax compliance and recordkeeping: You’ll need to keep detailed records of your sales data for tax purposes, including total revenue generated, expenses related to the sales, the campaign timeline, etc. This will help determine whether the revenue is subject to UBIT and the total taxable revenue (if applicable).

- Financial transparency: Detailed financial records help your nonprofit maintain financial transparency, building trust and credibility. Account for all expenses and revenue related to the campaign and be transparent about how your organization spends the funds.

- Strategic planning: Tracking progress during the campaign allows you to see how close you are to your goal and make adjustments in real time. This allows your nonprofit to make last-minute, strategic decisions that help you reach your target.

You can also use this data to enhance future campaigns. For example, perhaps you overstocked a product that didn’t sell well—in the future, you’ll know to order fewer items. Or, maybe you notice patterns in buying behaviors that you can take advantage of to maximize revenue.

Selling products can drive meaningful revenue for your organization, which ultimately supports your mission, expands your programs, and helps you touch more beneficiaries with your work. However, you’ll need to follow guidelines outlined by the IRS to ensure the revenue from these activities remains tax-exempt. Being informed about these guidelines and which activities are subject to UBIT allows your organization to maximize funding and protect its tax-exempt status.

To learn more about how to effectively earn revenue and comply with tax regulations, explore these additional resources:

- The Best Guide to Bookkeeping for Nonprofits: How to Succeed. Learn about the basics of bookkeeping for nonprofits and why it’s so important to your success.

- How to File a Form 990: Best Practices for Easy Preparation. In addition to reporting fundraising revenue, there are many factors at play when it comes to filing your Form 990. Discover the best practices for filing.

- 17 Fundraising Products You Should Be Selling. Now that you have a deeper understanding of UBI compliance, explore these fundraising product ideas to engage supporters.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

Comments (0)