Judge Orders IRS to Answer Questions Regarding Lerner Emails

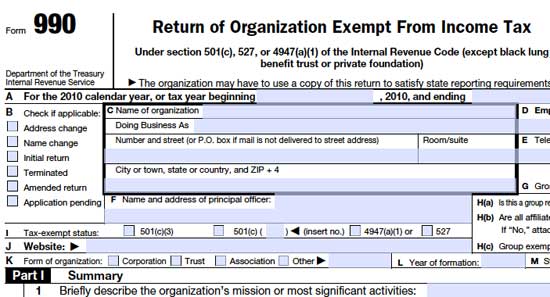

The IRS has been ordered to answer questions on the status of certain emails of former exempt director Lois Lerner. The federal judge has ordered the agency to answer questions in response to a Freedom of Information Act request filed…