What is IRS Form 990-PF?

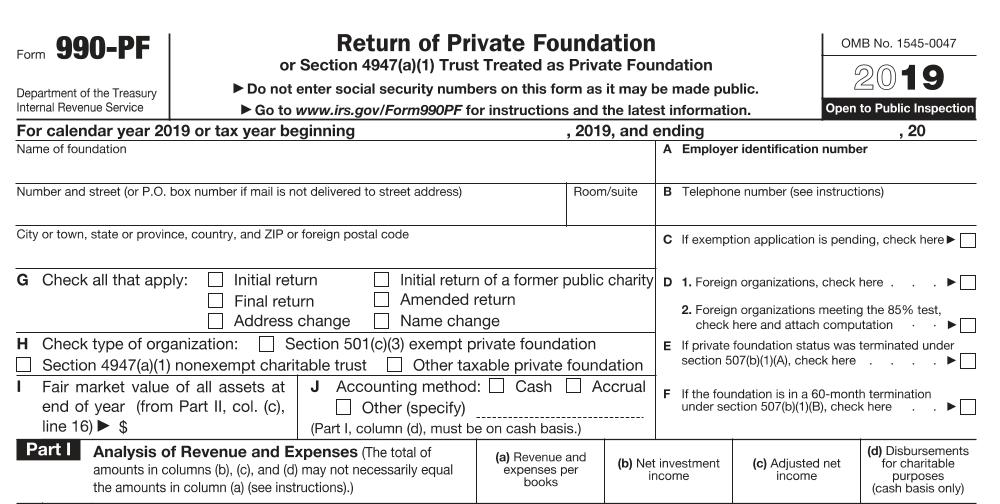

Private foundations are a unique class of 501(c)(3) organization…so unique, in fact, that they have their own exclusive version of IRS Form 990, called Form 990-PF. In this post, our 5th in this series, we’re going to examine just what makes Form 990-PF so different from its counterparts.

Though there are exceptions, private foundations are typically not engaged in public-facing, charitable programs. Nor is it customary for a private foundation to be soliciting the public for donations. It is far more normal that a private foundation be closely funded and primarily grant money to public charities to assist the charities in their activities. As such, the IRS is looking for very different information than what we have talked about previously.

Form 990-PF requires detailed disclosure of revenue and expenses by category. While this is similar to other versions of the tax return, it differs in focus to reflect activity more in line with how private foundations operate. In addition, because foundations often have investments and/or endowments, considerable attention is given to investment earnings and capital gains. Surprisingly to some, foundations are actually subject to a small excise tax, usually 2% or less*, on investment income. This excise tax is something public charities do not pay.

Also similar to other versions of the return, much attention is given to “yes/no/explain” type questions. Some of the questions are like those asked of public charities, while others are looking more closely at areas of concern unique to private foundations, such as prohibited dealings with individuals the IRS considers disqualified persons. Disqualified persons are typically board members, substantial contributors, key employees, or family members of the same. Prohibited dealings, particularly those involving financial activity, can result in steep fines to the foundation.

Another area of focus unique to Form 990-PF is the required expenditures for charitable purposes. Per the IRS,

“Private foundations are required to spend annually a certain amount of money or property for charitable purposes, including grants to other charitable organizations.”

The generally accepted rule calls for 5% of the foundation’s financial assets to be distributed, but it is actually more complicated than that. Part X of Form 990-PF calculates the minimum investment return, which is then used to calculate the distributable amount in Part XI. There are a number of factors that go into each calculation, making the formula considerably more complicated than a roughly-applied 5%, though the result is often close to that. Amounts distributed for charitable purposes above the distributable amount may be carried forward up to 5 tax years to offset that year’s distributable amount. Under-distributions not covered by a previous year carryover can be hit with an excise tax.

Like all versions, Form 990-PF is due on the 15th of the 5th month, following the end of the tax year. There is a paper version of the form which may be filed by mail, as well as the ability to file electronically with the IRS (which they prefer). A six-month extension is available by filing IRS Form 8868 by the original due date of the return. Like other versions, significant penalties are assessed for late filing.

Where Form 990-PF differs greatly is in the filing threshold…there is none! Where public charities file a version of Form 990 that gets progressively more complex as income increases, private foundations are liable for the entire Form 990-PF, regardless of income. In fact, if a private foundation has zero gross revenue for the year, and even takes a loss on its investments, it still must prepare and submit a complete return.

Form 990-PF is a complex, 13-page return (at a minimum). If you happen to read the IRS instructions for the preparing Form 990-PF, it estimates that expected preparation time exceeds 33 hours! As the old saying goes, your results may vary. Needless to say, preparation of Form 990-PF is best left to the experts. If your foundation needs help, let us know. We’re here for you. Our staff accountants know these returns inside and out, and we won’t need 33 hours to do it!

* For tax years beginning on or before December 20, 2019, the excise tax is 2% of net investment income, but is reduced to 1% in certain circumstances. For tax years beginning after December 20, 2019, the excise tax is 1.39% of net investment income, and there is no reduced 1% tax rate.

who subscribe to our free, email newsletter. It’s information that will empower your nonprofit!

This Post Has 4 Comments

Comments are closed.

Hello can someone help me with a question ? In what circumstances would a charity need to fill out both a form 990 and a 990pf ? thanks in advance

They wouldn’t…ever. Form 990-PF is only for private foundations, while public charities, and other tax-exempt nonprofits, file Form 990.

Hi Greg,

Thank you for this and your other extremely important posts as I help start a small nonprofit that is separating from a fiscal sponsor. I have gone through a number of the different posts and comments trying to understand the ‘not for private benefit’ aspect. My specific comment relates to a book that was written (outside of office hours) by an employee who used some of the IP (activities that are part of a training manual and had been created by her). Now that it’s the new 501c3’s responsibility, what are our options for allowing her to retain use of that IP for her for-profit venture and being compliant? Can we give her full ownership of those training activities within her book although they had originally been developed by a nonprofit entity (because that would be easiest)? Or can we co-own just those activities or the manual, and she can promote/use her book how she pleases? Otherwise, I think we can license those pieces to her perpetually, but I don’t know if we would have to consider any compliance requirements around the ‘not for private benefit’ piece. Please let me know if you can share some thoughts on this… before I have to tackle the tax forms! Thanks.

Thanks for reaching out, Elizabeth. There’s simply too much here to give a sufficient answer in a small space. IP and private benefit gets tricky. We don’t normally solicit business directly in the comments, but…this sounds like one of those situations where you could benefit from engaging in a paid consultation. We can help you put together a license arrangement that should work for both parties. If you call our office, ask for Brenda and tell her I recommended you call her. She can set up an consultation between you and I.